Gold Price Forecast: Bears looking to engage on break of daily support

- Gold is opening the week on the back foot as the US dollar stays firm.

- FOMC, covid, growth and inflation risk all point to a solid US dollar.

- XAU/USD bears await break below 100-day SMA at $1,796.

The gold price on Friday ended lower by 0.26% in XAU/USD falling from a high of $1,810.37 to a low of $1,789.69. XAU/USD was oscillating around the $1,800 psychological level for the most part.

The US dollar notched a second week of gains following a number of volatile days pertaining to the ebb and flow in risk appetite ahead of the Fed for the week ahead.

The focus is on US data and inflation in the main.

The Federal Reserve this week will be expected to indicate that tapering should emerge in 4Q this year, with the possibility of a first hike coming in 4Q22.

If 2Q21 GDP growth – expected at 8-9% quarter-on-quarter annualised – plus also June readings for personal consumption and the PCE deflator, all arrive strong, the US dollar should continue to prosper within the US dollar smile theory. Subsequently, this could weigh on the commodity complex for the weeks ahead.

''Gold remains vulnerable to further increases in real rates as both inflation and nominal rates normalize,'' analysts at TD Securities said.

The dollar index DXY, which measures the greenback against a basket of six major currencies, for the week, was up 0.1%, after rising 0.6% previously.

We had seen a 3-1/2-month high in the DXY of 93.194 touched on Wednesday and should the market revisit there or beyond, gold prices would be expected to fall further.

The week ahead will also see the IMF release an interim update on its World Economic Outlook and there will be specific interest in the concerns elsewhere in the world fuelled by the Delta variant.

With this in consideration, the MSCI index which captures large and mid-cap representation across 27 Emerging Markets (EM) countries, is down nearly 8% since June in the confluence of the rising US dollar and covid cases around the world.

The prospects of vaccine boost in developed nations could bring about additional concerns in EM's as vaccine allocations start to dry up in the developing parts of the world.

An exodus from EM’s would continue to be supportive of the greenback and a headwind for gold prices in the meanwhile.

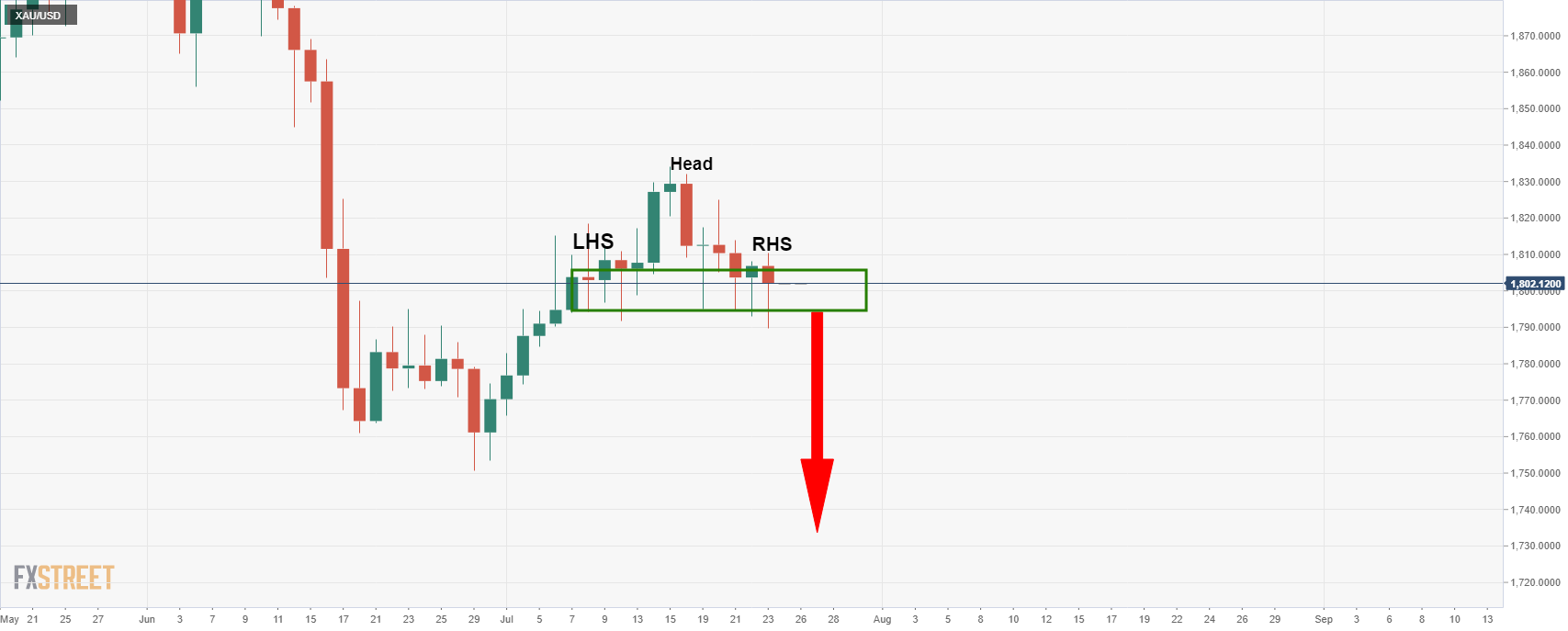

Gold technical analysis

Technically, a bullish reverse head and shoulders are taking shape on both the weekly and monthly charts.

However, there could be some downside yet to come.

A strong resistance between 1,811/30 has been in play and has forced last week's weekly candle to close bearish.

From a daily perspective, we are seeing a bearish H&S and the price has been testing the neckline.

A bearish breakout below the neckline (1,790) could eventually equate to a weekly downside continuation and a lower low for the weeks ahead.

This leaves the daily lows of 1,750 ahead of 1,730 vulnerable.

''Trend following strategies are set to add shorts below $1775/oz,'' analysts at TD Securities said.