Back

14 Jun 2021

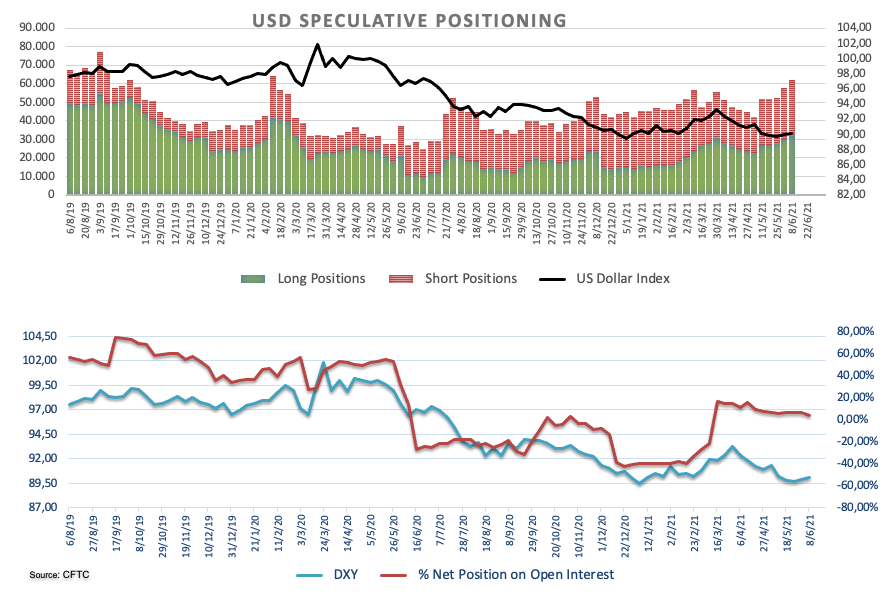

CFTC Positioning Report: Net longs in USD at yearly lows

These are the main highlights of the CFTC Positioning Report for the week ended on June 8th:

- Net longs in USD receded to the lowest level so far this year around 1750 contracts. The broad rangebound theme in the greenback prevailed during the period, as market participants remained vigilant ahead of the US CPI release and the ECB event, relegating somewhat the US economic recovery narrative instead.

- Specs scaled back their EUR gross longs (and gross shorts) for the first time in several weeks, taking the net longs to 2-week lows against the backdrop of erratic price action and rising cautiousness ahead of the ECB gathering.

- Net longs in crude oil climbed to levels last seen in early April on the back of the unabated rally, which in turns remain propped up by optimism on the global economic recovery and prospects of higher demand.

- In the safe haven universe, net shorts in JPY dropped to YTD lows while net longs in CHF rose to levels last seen in April.