Back

26 Aug 2020

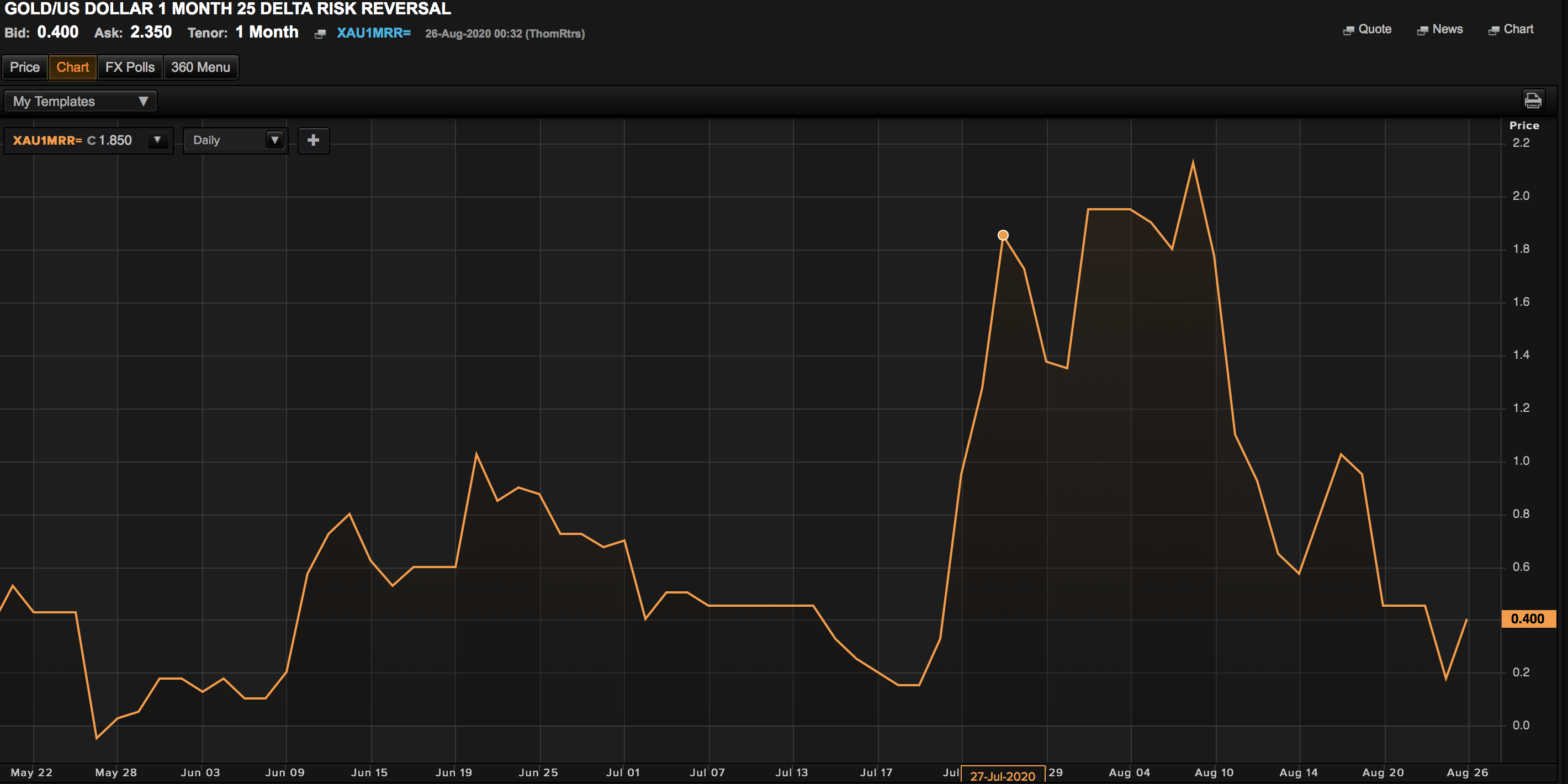

Gold risk reversals: Call bias weakens ahead of Jackson Hole Symposium

Risk reversals (XAU1MRR) on gold, a gauge of calls to puts on the yellow metal, traded at 0.40 in favor of XAU calls on Tuesday versus 2.125 on Aug. 7, according to data source Reuters.

The pullback is indicative of a decline in the premium claimed by call options or bullish bets over put options or bearish bets. In other words, demand for bullish bets has weakened ahead of Thursday’s annual Jackson Hole Economic Symposium, where Federal Reserve’s chairman Jerome Powell is expected to signal tolerance for above-target inflation.

Gold is currently trading largely unchanged on the day near $1,928 per ounce at press time, having reached a record high of $2,075 on Aug. 7.

XAU1MRR