EUR/USD Price Analysis: Holds near 1.16, daily RSI shows overbought conditions

- EUR/USD remains bid near 1.16 as dollar sell-off continues.

- Bias remains bullish despite the overbought reading on the daily RSI.

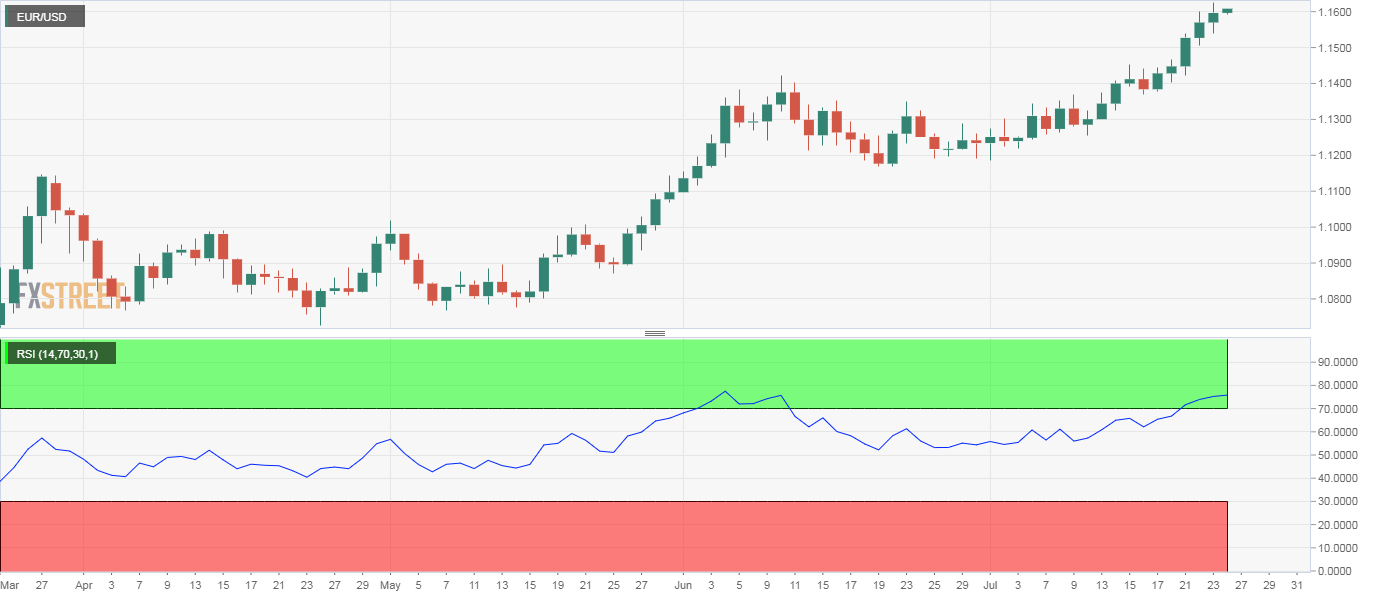

EUR/USD is trading near 1.16 at press time, having hit a multi-month high of 1.1627 on Thursday.

The 14-day relative strength index is now reporting overbought conditions with an above-70 print. The currency pair has gained over 1.6% this week and is up nearly 1,000 pips from the March low of 1.0636.

As such, one may feel tempted to abort the bullish bias. However, an overbought reading on the RSI does not imply a bullish-to-bearish trend change. It simply means the rally has gone too far in a short time and indicates scope for temporary consolidation.

In addition, the overbought reading needs validation from the price chart. As of now, there are no signs of buyer exhaustion on the daily price chart. Besides, in a strong trending market, the indicator can remain overbought for a prolonged period of time.

Put simply, the bias remains bullish despite the overbought reading on the RSI. Key levels to watch out for on the higher side are 1.1616 (May 2016 high) and 1.18 - the resistance of the trendline falling from July 2008 high and May 2014 high. On the lower side, 1.1495 (March 9 high) is the level to beat for the bears.

The 4-hour chart is reporting a bearish divergence of the RSI. Hence, a minor pullback to 1.1550 cannot be ruled out.

Daily chart

Trend: Bullish

Technical levels