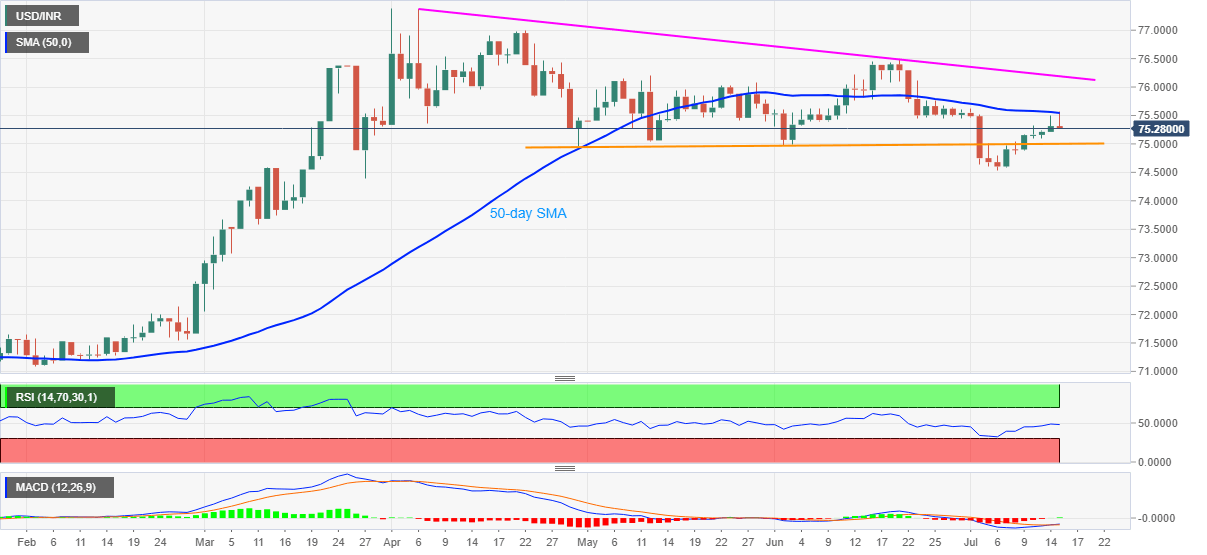

USD/INR Price News: Indian rupee recedes from two-week low as 50-day SMA plays its role

- USD/INR extends weakness from 75.57, snaps four-day winning streak.

- 11-week-old horizontal support grabs bears’ immediate attention, bulls will have a bumpy road ahead.

- Normal RSI suggests the pullback to fade momentum once reaching the nearby support.

USD/INR drops to 75.28, down 0.05% on a day, ahead of the European session on Wednesday. In doing so, the pair steps back from the highest since July 01 while respecting 50-day SMA as the key resistance.

Considering the pair’s repeated failures to cross the key SMA since June 23, the quote is likely to revisit multi-day-old horizontal support near 75.00. Though, its further downside could be challenged by RSI and MACD conditions.

If at all the quote remains weak past-75.00, the monthly bottom near 74.52 and a late-March low of 74.40 could challenge the sellers ahead of highlighting 74.00 on their radars.

Meanwhile, the pair’s successful break above 50-day SMA level of 75.55 will have to clear 75.80 resistance to aim for the May-end peak near 76.10.

Even so, the bulls won’t have a proper grip over the USD/INR pair as a falling trend line from April 06, at 76.19 now, stands tall to challenge the further upside.

USD/INR daily chart

Trend: Pullback expected