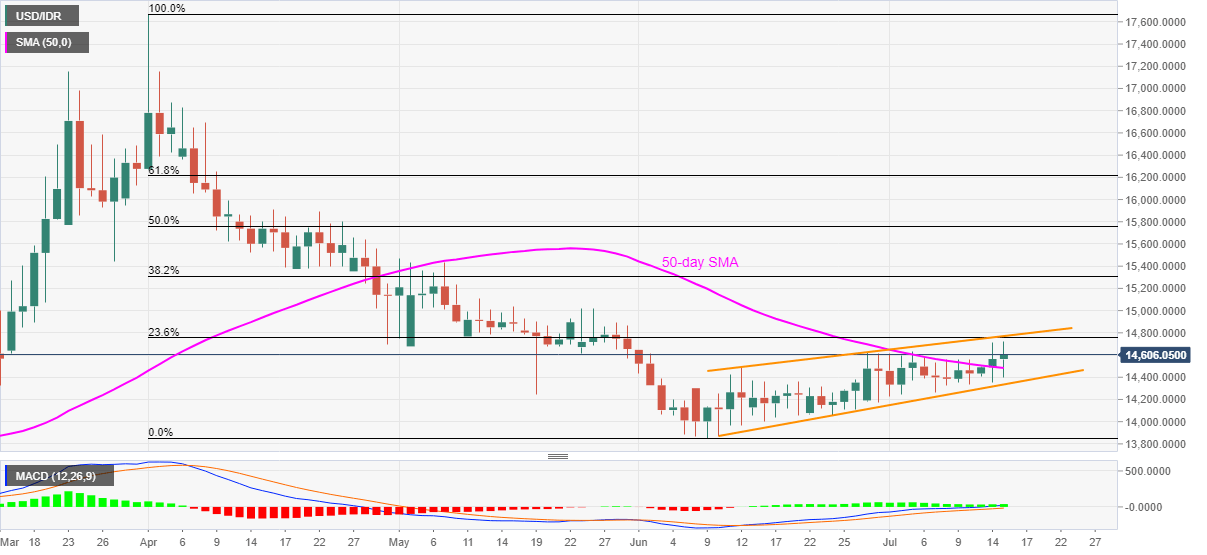

USD/IDR Price News: Indonesian rupiah bears await trade data to cheer break of 50-day SMA

- USD/IDR stays near the highest levels in seven weeks ahead of the key Indonesian trade numbers.

- Forecasts suggest decline in headline Trade Balance from $2.09B to $1.11B, Exports and Imports are likely to recover.

- Monthly ascending trend channel could restrict the pair’s run-up beyond the key EMA.

USD/IDR prints 0.28% intraday gains while trading around 14,605 amid the early Wednesday. The pair portrays a third positive day following its upside break of 50-day EMA on Tuesday. Even so, traders are waiting for June month Indonesian trade numbers to predict near-term moves inside an upward sloping trend channel established since June 10.

Should the Indonesian economics continues to linger, the pair might attack 14,750/70 resistance confluence comprising 23.6% Fibonacci retracement of April-June fall and the upper line of the said channel.

In a case where the bulls manage to cross 14,770 barriers, they can aim for 15,000 thresholds before confronting late-May top near 15,020.

Alternatively, upbeat data could drag the pair back to a 50-day SMA level of 14,480. Though, the further downside will be challenged by the channel’s support of 14,335.

It should be noted that any downside past-14,335 will not only be detrimental for 14,000 mark but can also challenge June month’s low near 13,850.

USD/IDR daily chart

Trend: Pullback expected