NZD/USD Price Analysis: Drops further below 0.6000 on Chinese statistics

- NZD/USD refreshes intraday low after China Retail Sales drop below expectations.

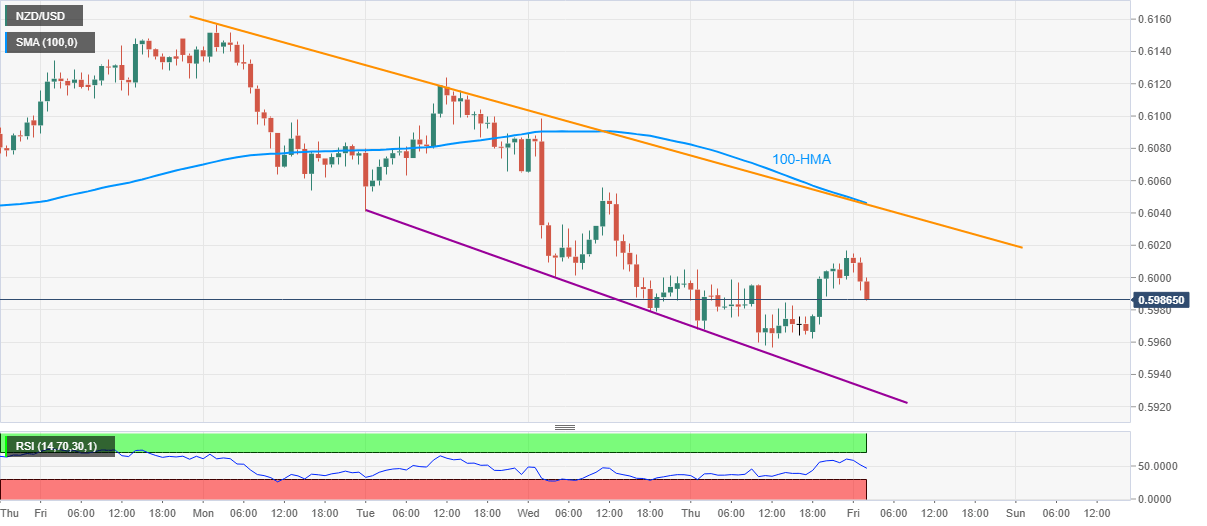

- Thursday’s low on the bears’ radar, a confluence of 100-HMA, weekly resistance line guards recovery moves.

NZD/USD drops the intraday low of 0.5987, down 0.27% on a day, after China’s Retail Sales disappointed Kiwi traders on early Friday.

China’s Retail Sales slipped below -7.0% forecast to -7.5% whereas Industrial Production grew more than 1.5% expected to 3.9% in April.

Read: China’s April data dump: Mixed Retail Sales and Industrial Production numbers – Aussie revisits lows

The pair currently aims to revisit the weekly low surrounding 0.5955 during the further declines. However, a descending trend line from May 12, close to 0.5930, followed by April 23 low near 0.5910, can lure the bears afterward.

On the contrary, a confluence of 100-HMA and a falling trend line from May 11 keeps the pair’s immediate upside guarded around 0.6045/50.

Should buyers manage to cross 0.6050, May 12 high near 0.6123 can return to the charts.

NZD/USD hourly chart

Trend: Bearish