Back

30 Mar 2020

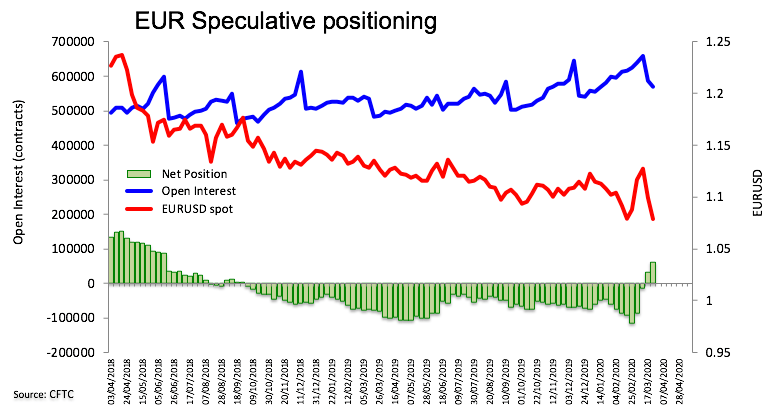

CFTC Positioning Report: EUR net longs in nearly 2-year highs

These are the main highlights of the latest CFTC Positioning Report for the week ended on March 24th:

- Speculators kept the positive view on EUR for the second week in a row, taking net longs to the highest level since mid-June 2018. The sell-off in the greenback plus the positive current account position in the euro region kept supporting the sentiment in the shared currency.

- GBP net longs were reduced to the lowest level since late December 2019. Further BoE stimulus, uncertainty around Brexit going forward and fragile position of UK current account appear to have been weighing on the outlook for the quid in the past seven days.

- Net shorts in CAD climbed to the highest level since June 18th 2019. The sharp sell-off in crude oil prices in combination with looser monetary conditions announced by the BoC sustained the negative momentum in the positioning space.