Back

24 Mar 2020

EUR/USD Price Analysis: Euro consolidates March’s selloff, trades below 1.0800 figure

- EUR/USD’s reaction up to Fed’s QE ‘unlimited’ is being limited.

- Resistance is seen near the 1.0850 price level.

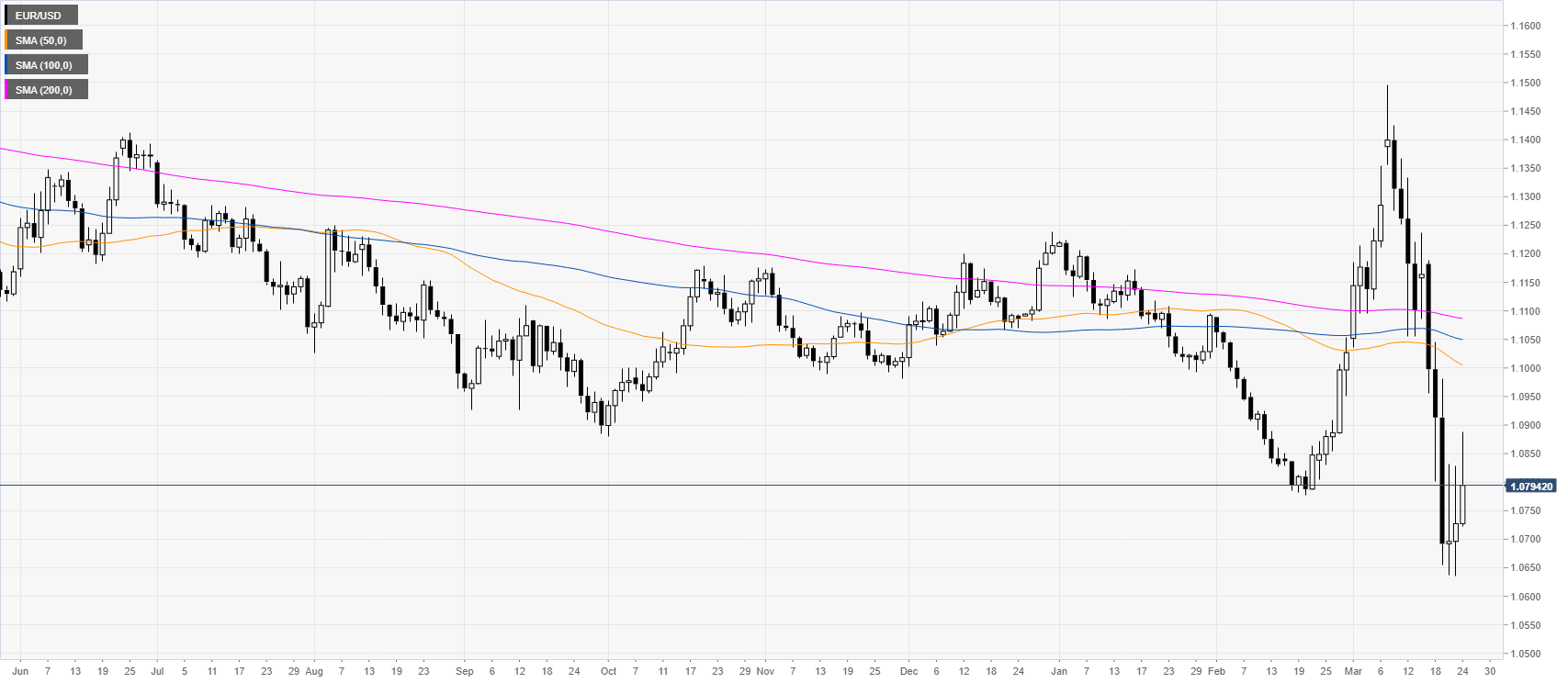

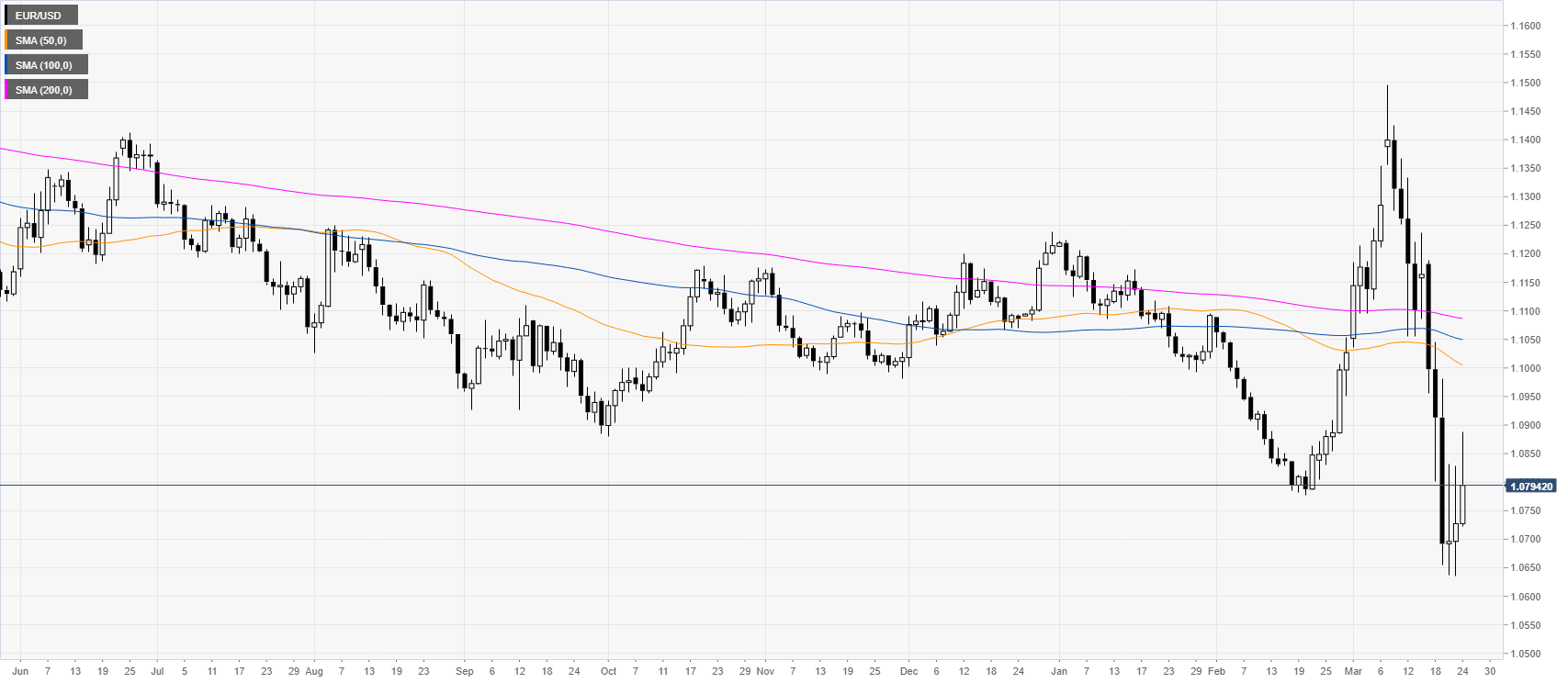

EUR/USD daily chart

After an above-average decline, EUR/USD is stabilizing near 37-month lows as the Fed announced, this Monday, its largest stimulus package ever. The Quantitative Easing could essentially be limitless. “The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions,” the Fed wrote.

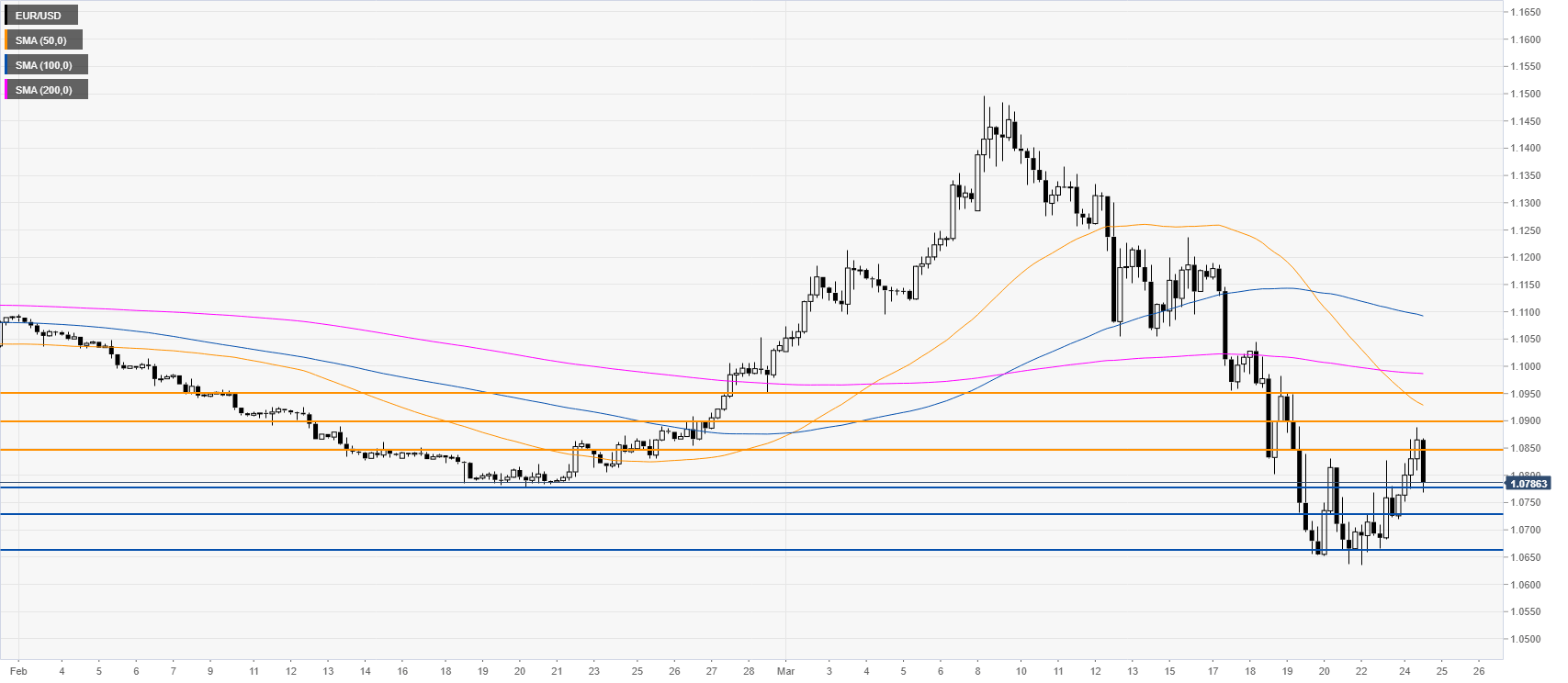

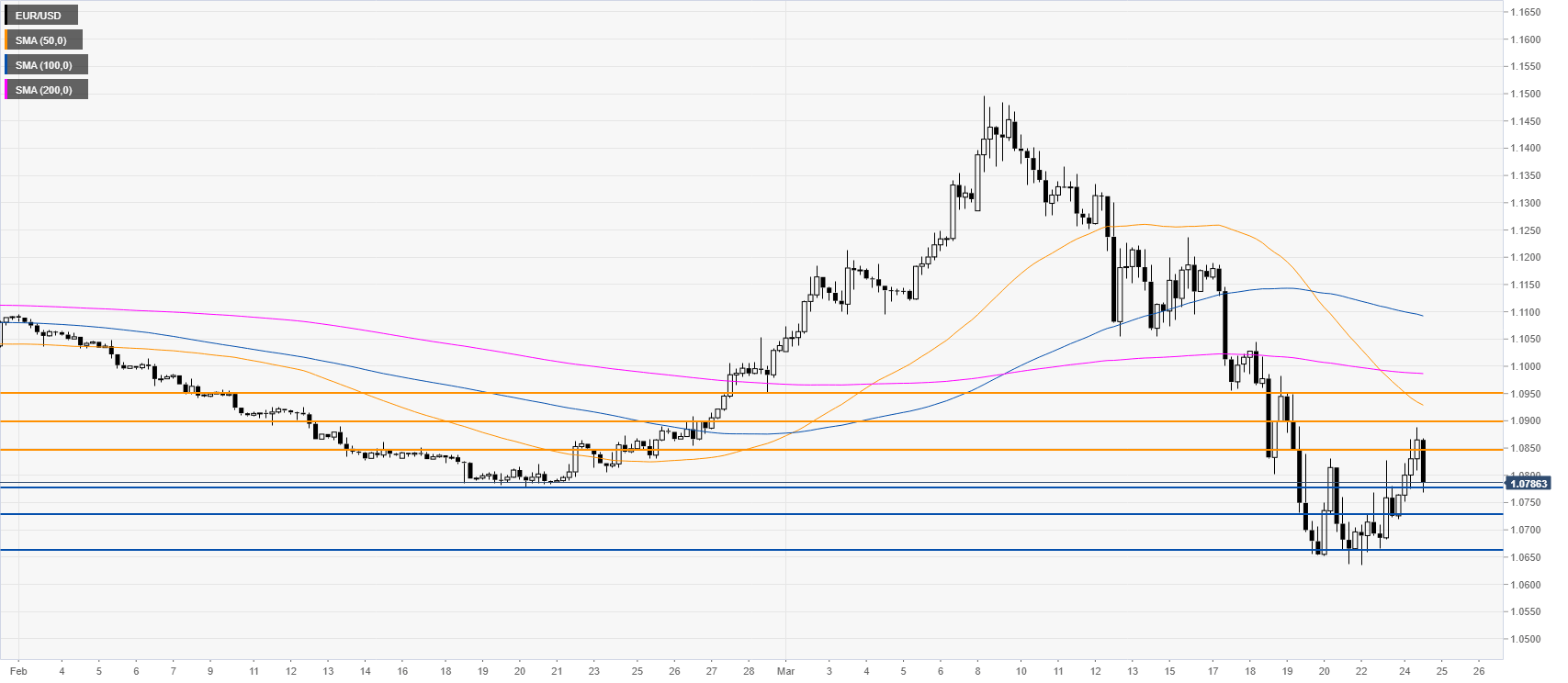

EUR/USD four-hour chart

The euro keeps consolidating losses near monthly lows while trading below its main SMAs. Interestingly, the 50 SMA crossed below the 200 SMA which adds credence to the bearish case. For the second time this week, the bulls launched an attack and they almost reached the 1.0900 figure this Tuesday, but there was no follow-through and the price is now back near the 1.0800 level as the overall bias remains bearish for EUR/USD.

Resistance: 1.0850, 1.0900, 1.0950

Support: 1.0780, 1.0732, 1.0665

Additional key levels