Back

23 Mar 2020

EUR/USD Asia Price Forecast: Euro stays under pressure despite Fed’s QE Infinity, trading sub-1.0800 figure in 37-month lows

- EUR/USD reaction up to Fed’s QE ‘unlimited’ was short-lived.

- Resistance can be expected near the 1.0790 and 1.0857 levels.

- Bears are pressuring the 1.0723 support level ahead of the Asian session.

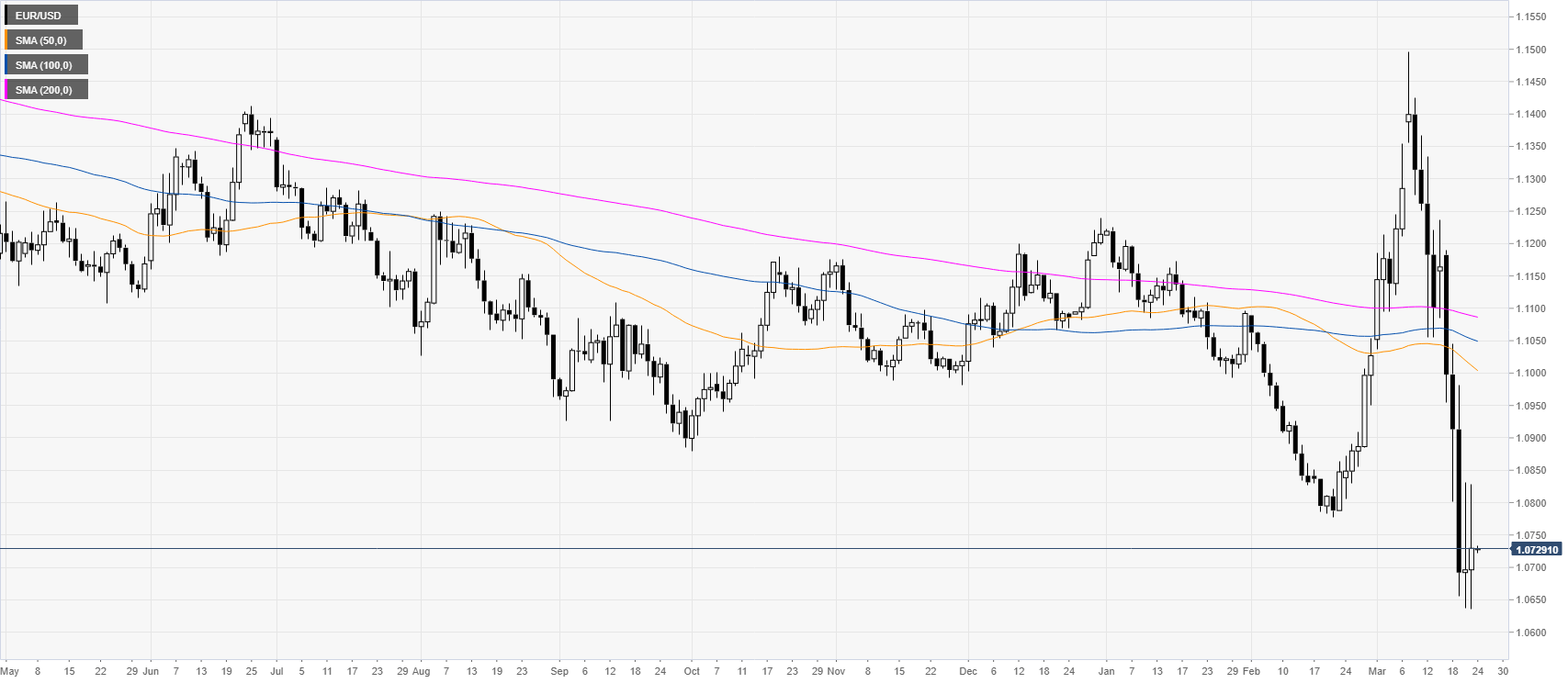

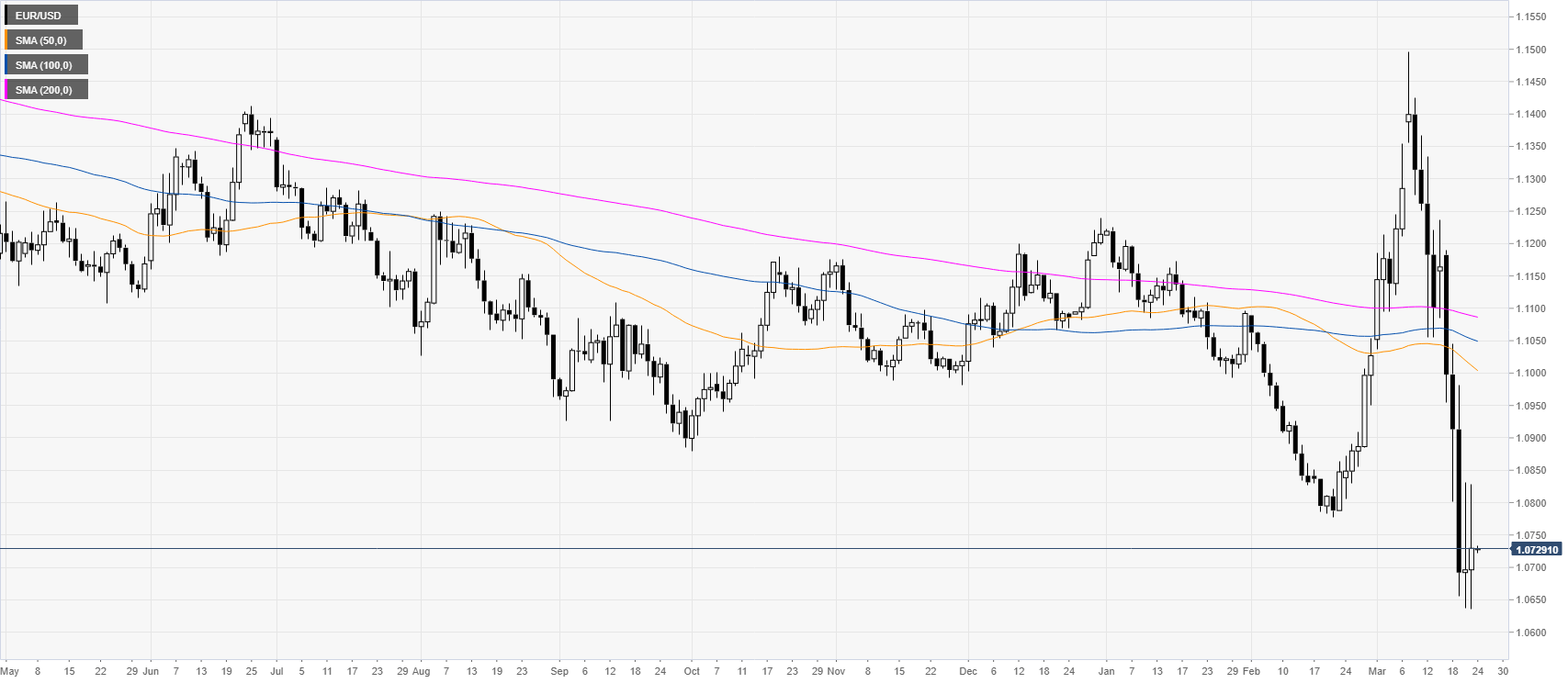

EUR/USD daily chart

After an exceptional decline, EUR/USD is stabilizing near 37-month lows as the Fed announced its largest stimulus ever. The Quantitative Easing could have essentially no limit. “The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions,” the Fed stated.

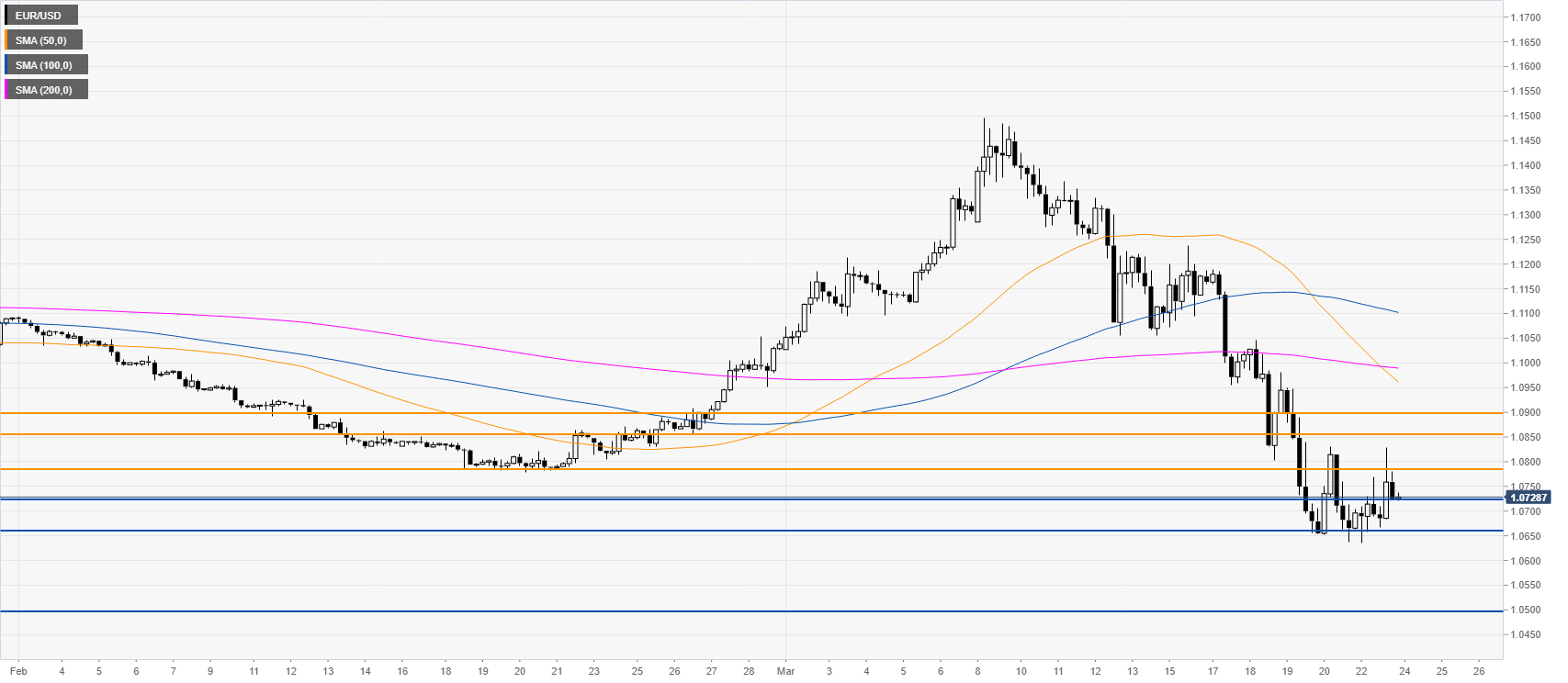

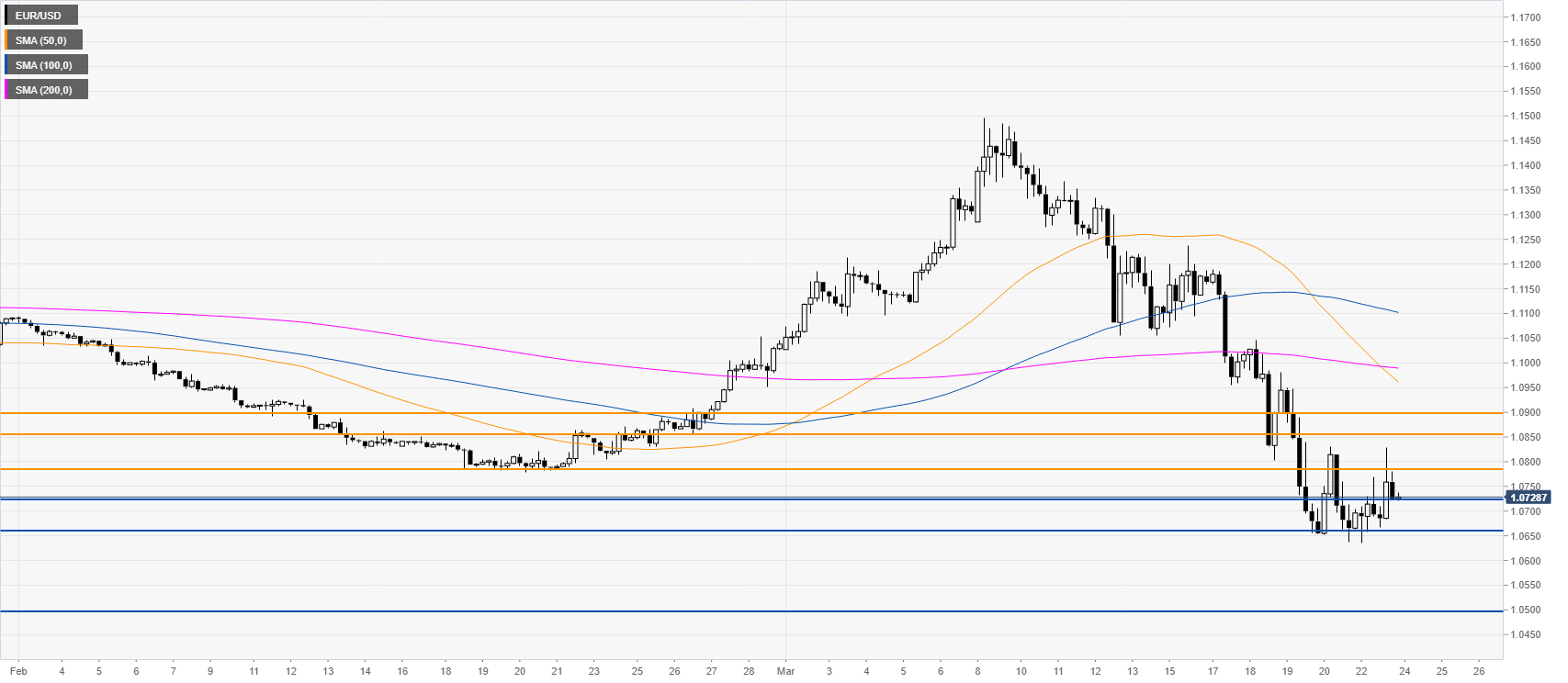

EUR/USD four-hour chart

The euro is consolidating losses near monthly lows while trading below the main SMAs. As a matter of fact, the 50 SMA crossed below the 200 SMA which adds to the bearish case. Earlier, bulls attempted a reversal up this Monday (Fed’s QE announced) but met selling interest near the 1.0800 figure. In this context, it seems that only a strong catalyst could help the euro bulls as the sellers remain firmly in control. A break below 1.0723 could lead to more weakness towards the 1.0667 level which is near last week’s lows. If the market loses the above-mentioned level to the downside, the spot could accelerate further toward the 1.0500 figure.

Resistance: 1.0790, 1.0857, 1.0900

Support: 1.0723, 1.0667, 1.0500

Additional key levels