Back

23 Mar 2020

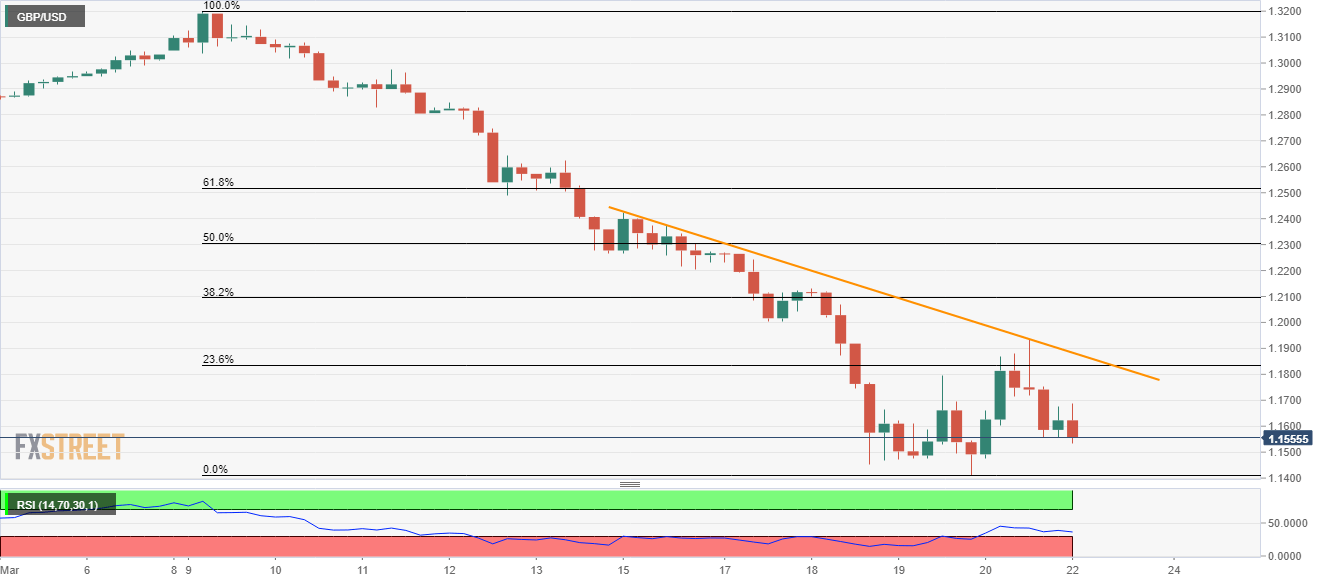

GBP/USD Price Analysis: Under pressure below weekly falling trendline

- GBP/USD fails to hold onto recovery gains beyond the short-term resistance line.

- The monthly low is in the spotlight, 61.8% Fibonacci retracement acts as the key resistance.

- The bears dominate amid US dollar strength, nearly oversold RSI conditions can challenge the sellers.

With the broad US dollar strength in place, GBP/USD drops 0.60% to 1.1550 during Monday’s Asian session.

In doing so, the Cable pair extends its U-turn from the one-week-old falling trend line, which in turn signals the revisit to the monthly low near 1.1410.

Should there be a further downside past-1.1410, also breaking below 1.1400 round-figure, the bears might extend the journey towards 1.1100 area.

However, nearly oversold RSI conditions seem to challenge the bears and hence buyers can take entry on the break of the trend line resistance, currently near 1.1885.

As a result, 1.2000 and 61.8% Fibonacci retracement of March 09-19 fall, near 1.2517 will gain the market’s attention.

GBP/USD four-hour chart

Trend: Bearish