EUR/GBP Price Analysis: 61.8% Fibonacci checks the bears

- EUR/GBP stays on the back foot, trades near the four-day low.

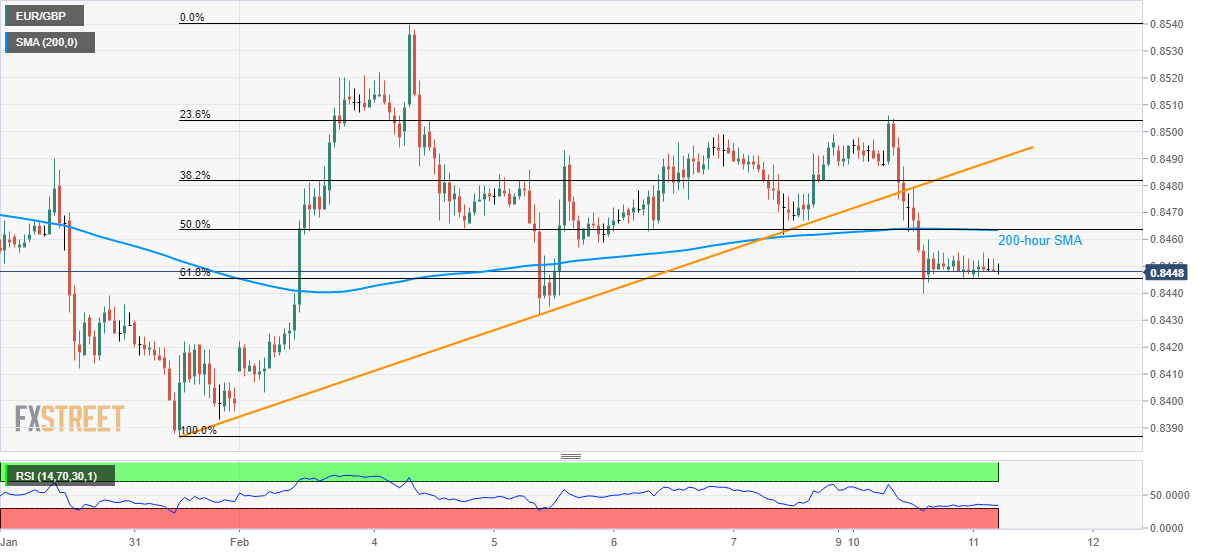

- The break of the short-term rising trend line, 200-hour SMA and 50% Fibonacci retracement recently lured sellers.

- Wednesday’s low can stop bears targeting January 31 low.

EUR/GBP declines to 0.8450, -0.06%, ahead of the European session on Tuesday. The pair sellers pause just above 61.8% Fibonacci retracement of January 31 to February 04 rise.

However, the pair’s recovery moves, also favored by the oversold RSI conditions, might find it difficult to cross 200-hour SMA and 50% Fibonacci retracement near 0.8465.

Even if the buyers manage to cross 0.8465, the support-turned-resistance line at 0.8490 and Monday’s top of 0.8506 will challenge the rise.

Meanwhile, a downside break below 61.8% Fibonacci retracement level of 0.8445 can revisit Wednesday’s low near 0.8430.

Should the bears fail to respect RSI conditions, January-end bottom around 0.8385 will be the key to watch.

EUR/GBP hourly chart

Trend: Pullback expected

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com