Back

9 Dec 2019

US Dollar Index price analysis: DXY consolidates gains above 97.55 level

- DXY is starting the week by consolidating last Friday’s spike up.

- The level to beat for buyers is the 97.85 resistance.

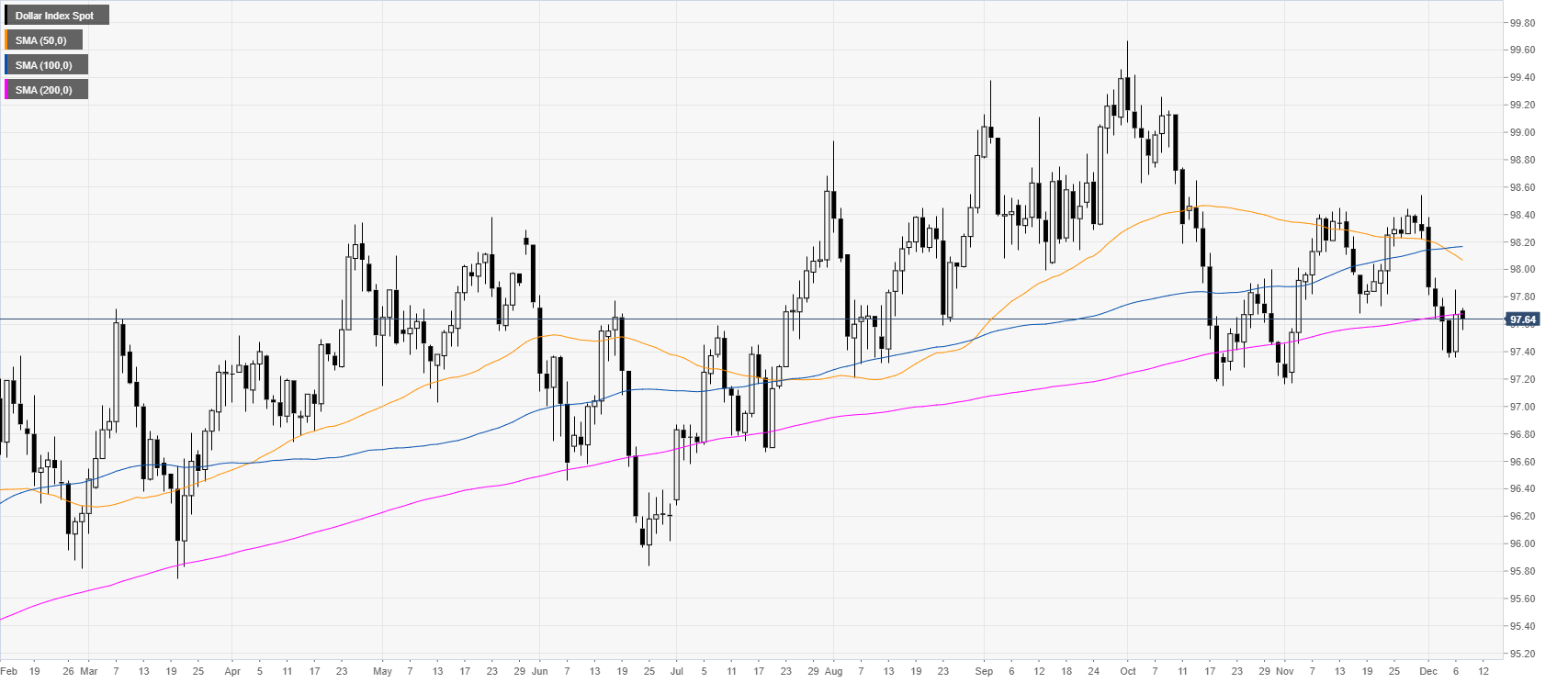

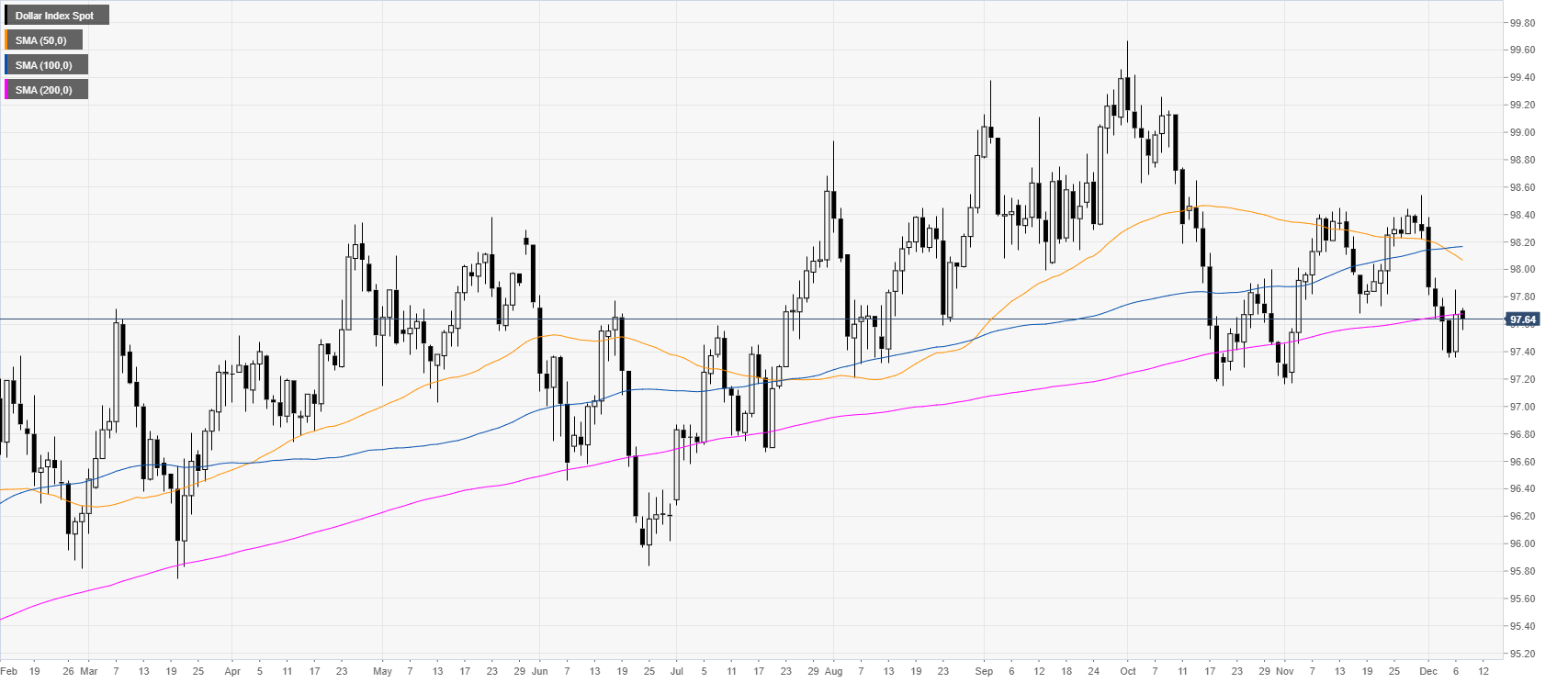

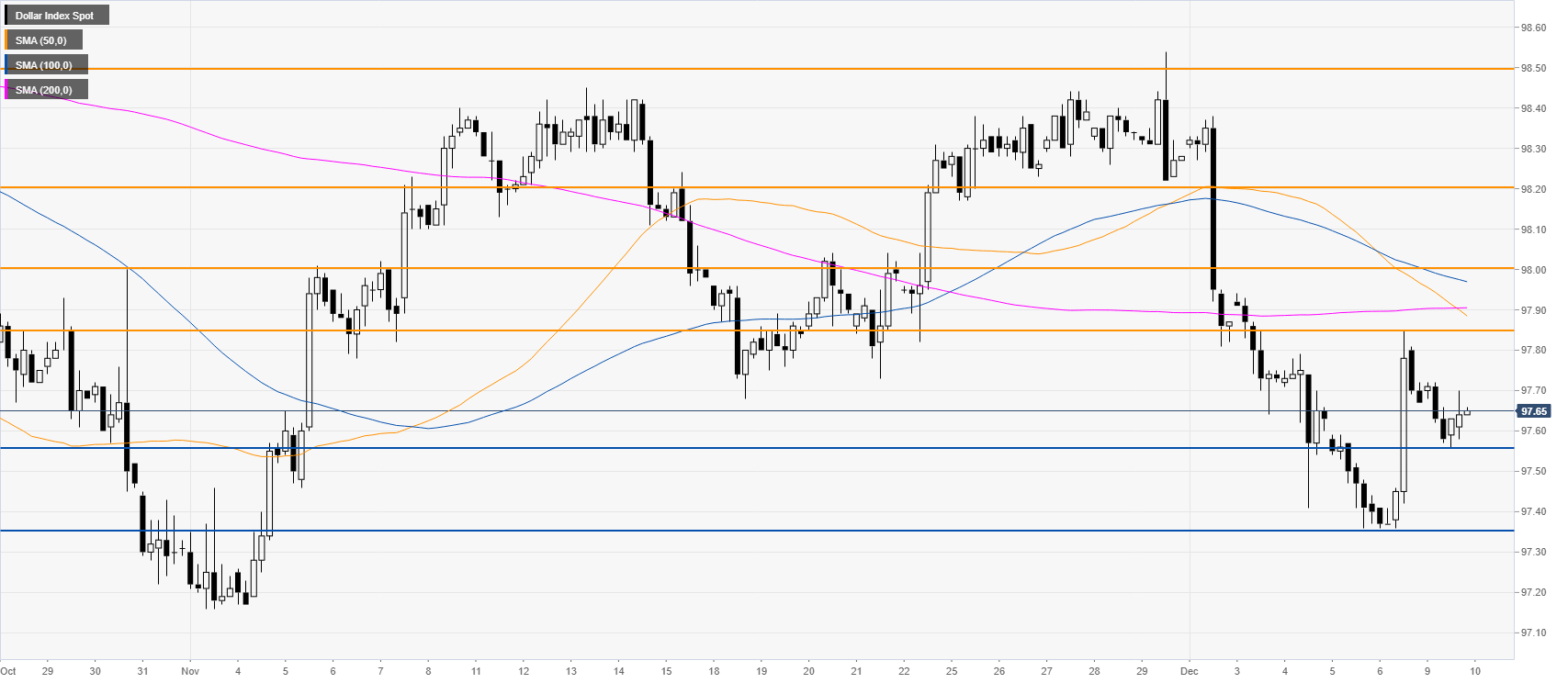

DXY daily chart

DXY (US Dollar Index) is evolving in a weak bull trend as the market is trading near the 200-day simple moving average (DMA).

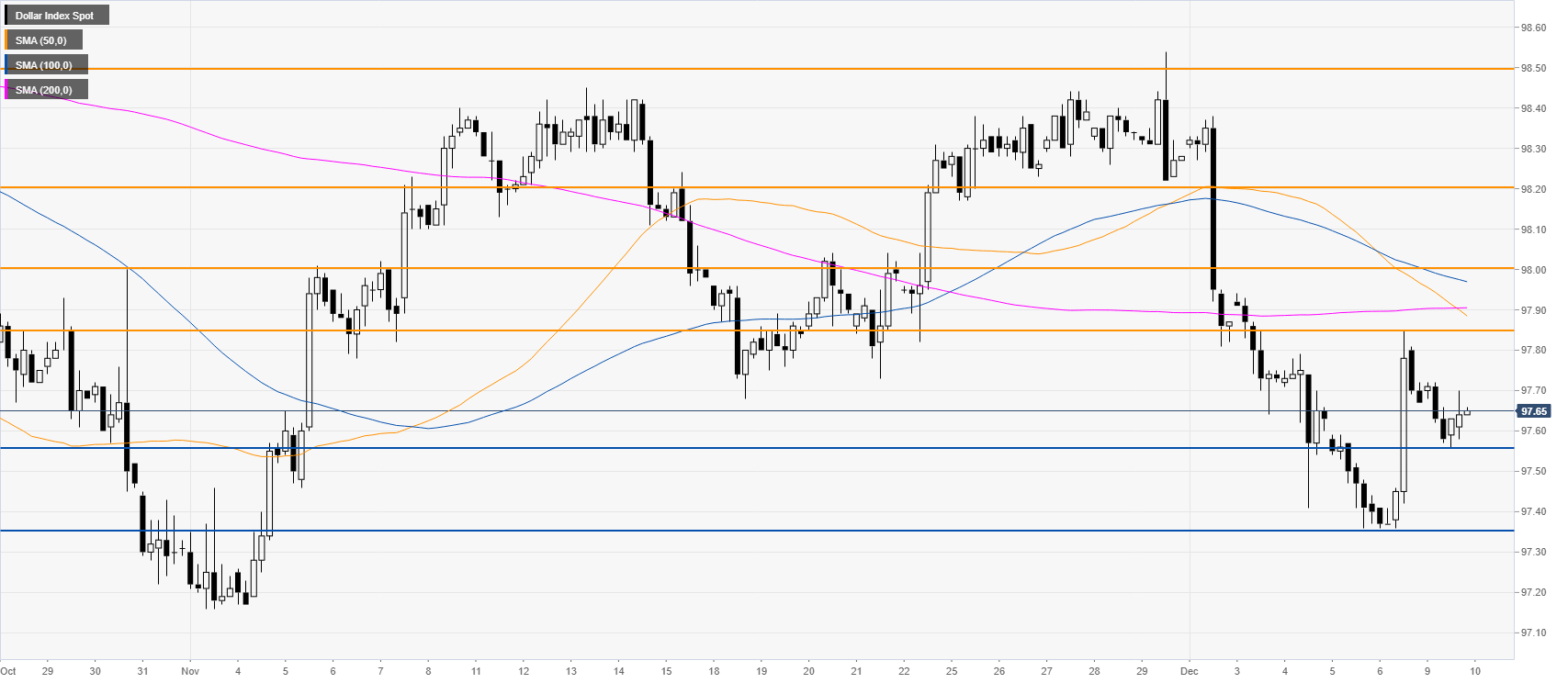

DXY four-hour chart

DXY remains in a range below the main SMAs. However, bulls are likely to take the lead on a break above the 97.85 resistance which can expose the 98.00/98.20 price zone. Further up lies the 98.50 level.

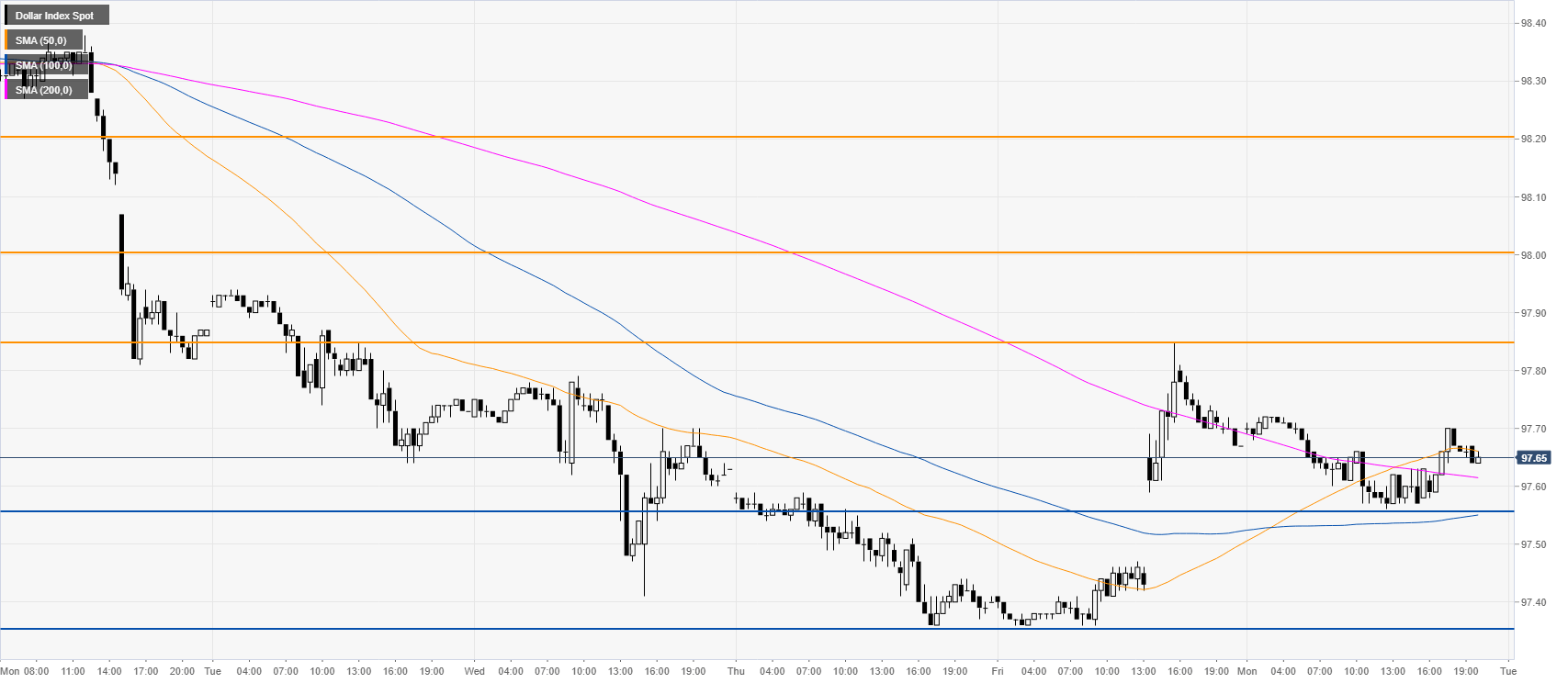

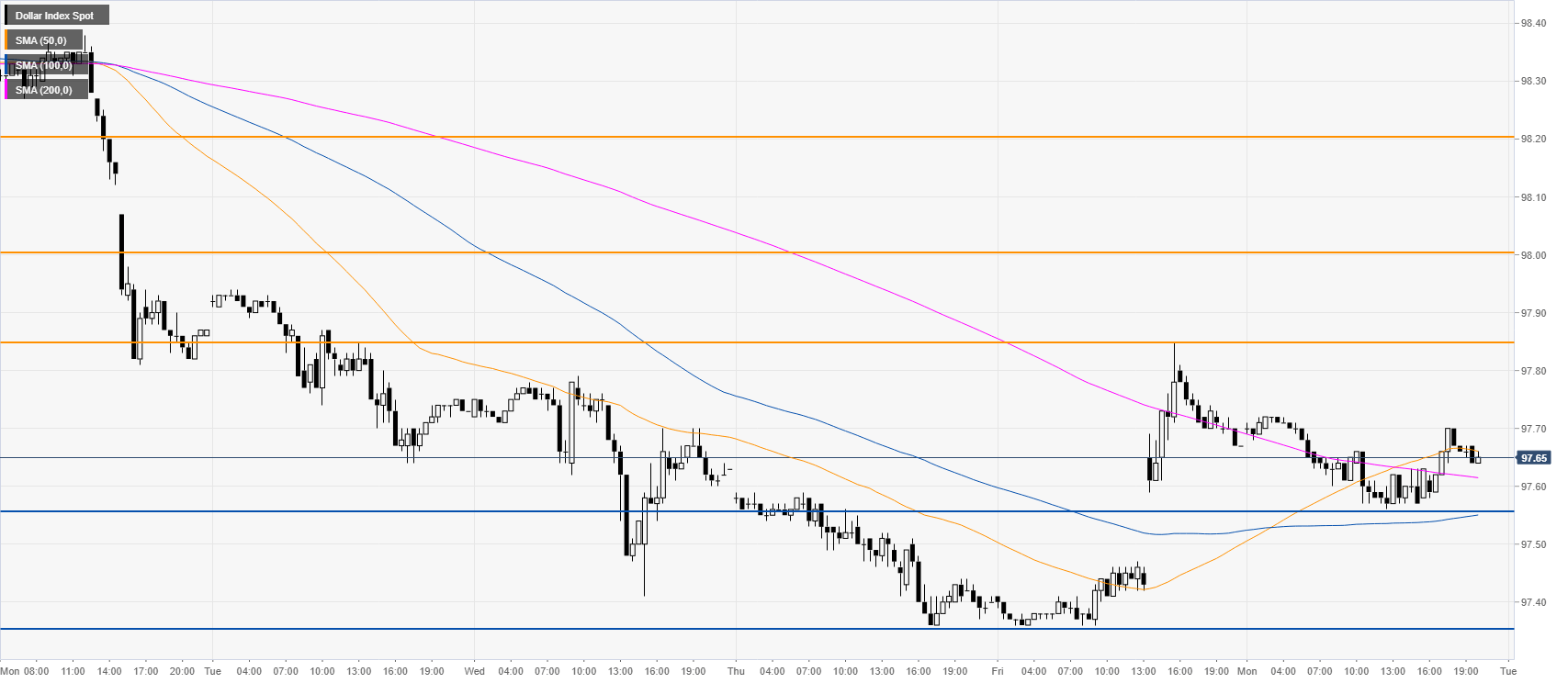

DXY 30-minute chart

DXY traded in a small consolidative range this Monday, although trading above the 100/200 SMAs into the New York close. Support is seen at 97.35 and 97.55 price levels.

Additional key levels