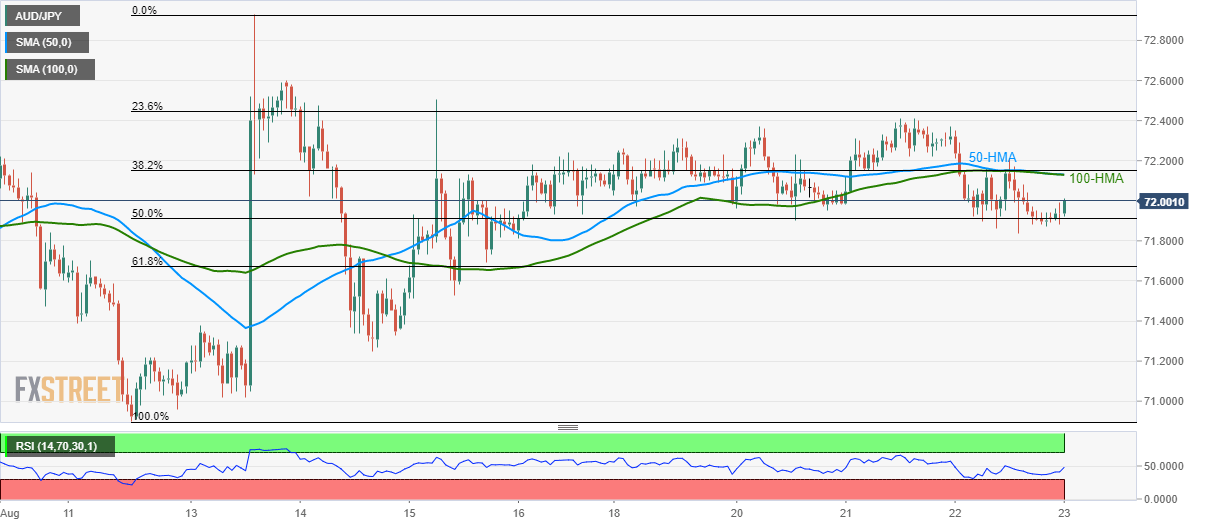

AUD/JPY technical analysis: Immediate upside capped by 50/100-HMA confluence

- AUD/JPY seesaws near 50% Fibonacci retracement.

- 50, 100 HMA confluence limit the quote’s near-term advances.

- 61.8% Fibonacci retracement, 71.40 becomes key supports to watch.

Despite its frequent bounces off 50% Fibonacci retracement of August 12-13 surge, AUD/JPY remains well below key resistance-confluence as it trades near 71.95 during the Asian session on Friday.

While pair’s recent recovery can help it clear 72.00 round figure, further upside will be challenged by 50 and 100-hour moving average (HMA) confluence, not to forget the 38.2% Fibonacci retracement, near 72.13/15.

If buyers manage to cross 72.15, 72.40 and 72.60 could offer intermediate halts to a run-up towards the last week’s high of 72.93.

On the downside, a clear break below 50% Fibonacci retracement level near 71.90 can fetch prices to 61.8% Fibonacci retracement level of 71.67 and then to 71.40.

During the pair’s additional declines below 71.40, 71.25 and August 12 low near 70.90 will please bears.

AUD/JPY hourly chart

Trend: Sideways