Back

26 Apr 2019

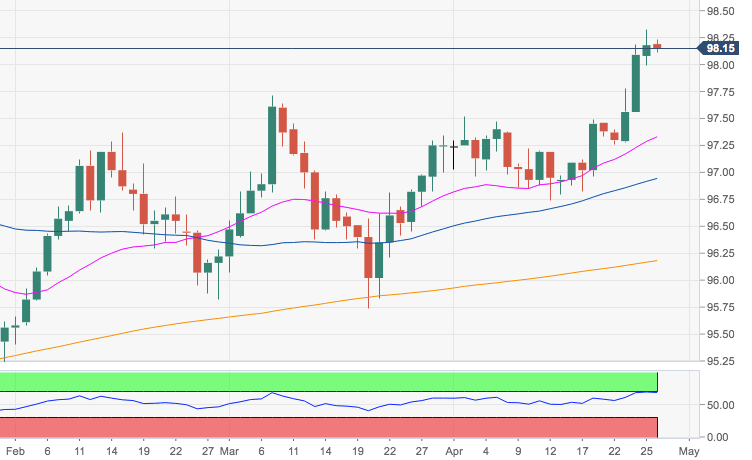

US Dollar Index Technical Analysis: Rally stays well and sound above 98.00. Contention emerges at the Fibo retracement near 97.90

- The upbeat note in the greenback remains intact so far this week and DXY manages well to keep the trade above the 98.00 barrier for the time being.

- Immediately above emerges the mid-100.00s as the next significant hurdle, where is located a Fibo retracement of the 2017-2018 drown move.

- In the meantime, occasional selling attempts should meet initial contention at 97.89, another Fibo retracement, while the outlook on the index stays constructive as long as the critical 200-day SMA at 96.13 underpins.

DXY daily chart