Back

22 Mar 2019

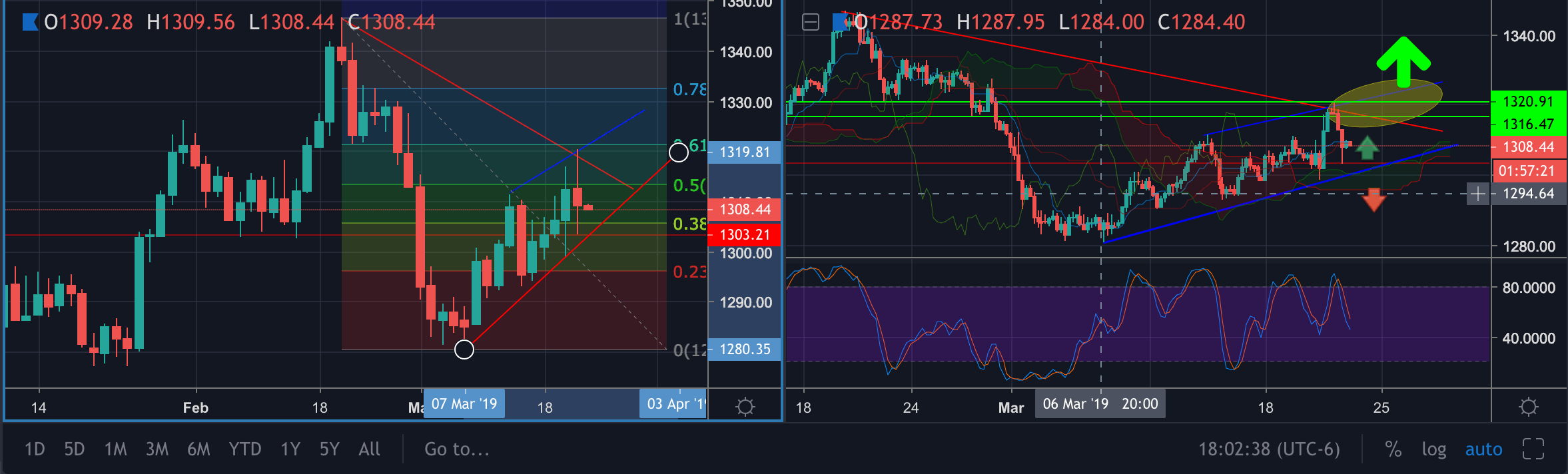

Gold Technical Analysis: Demand ahead of rising channel support leaves bias neutral/bullish

- Stochastics and price action leaves the immedaite outlook neutral/bullish.

- Bears are looking for a test of the 1302 support which will open 1295, 1290 while 1280 is a keen target.

- 1275 remains the line in the sand to the downside but a clearance below the cloud at 1295 offers a potential breakout trade below the rising channel.

- 1250, comes as a key confluence area made up of Fibos and prior support and resistance.

- On the next leg up, however, bulls can take on 1315/20 to open the runway towards 1332 which guards the 2019 highs as being the 19th Feb high of 1345.19.

- Pivot support levels: 1303 1291 1285.

- Pivot resistance levels: 1322 1328 1340.