EUR/USD Technical Analysis: Small bounce to 1.1280 on weak US Industrial Production

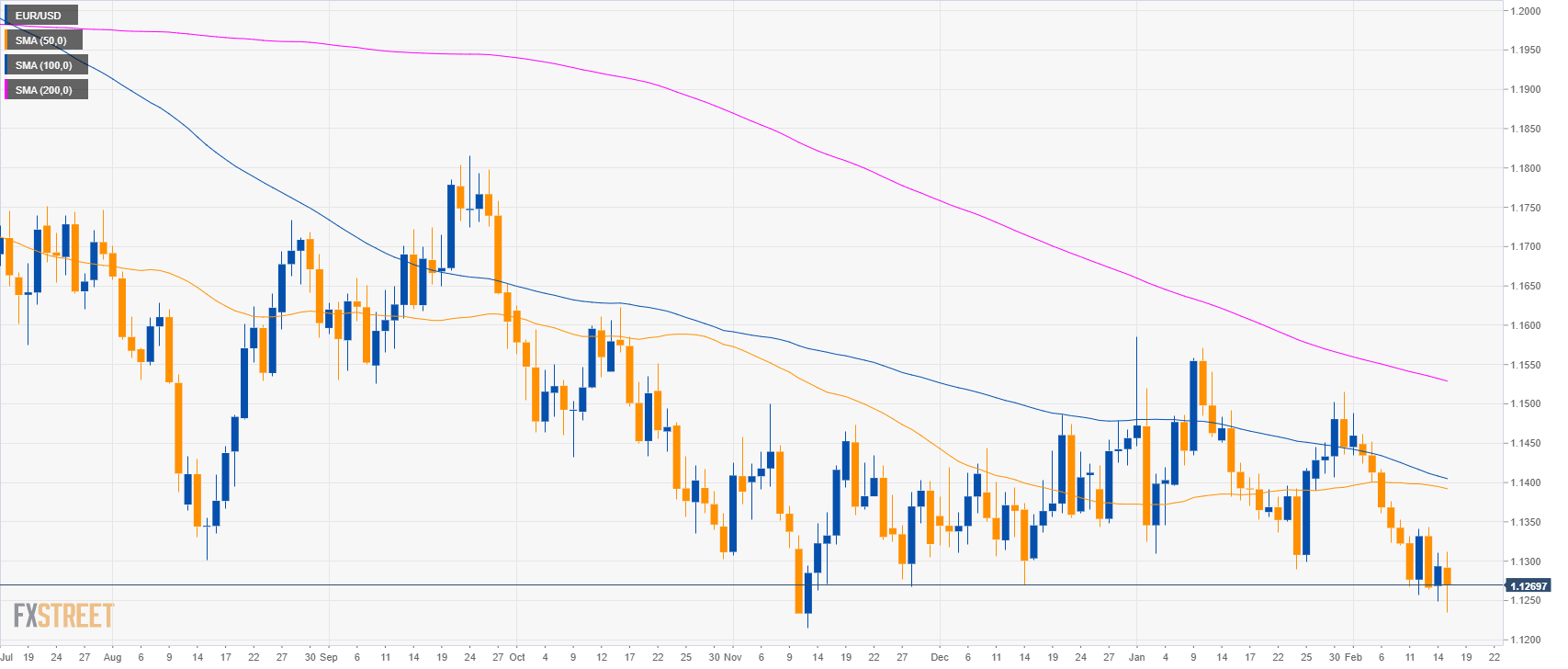

EUR/USD daily chart

- EUR/USD is trading in a bear trend below the 200-day simple moving average (SMA).

- The US Industrial Production in January (MoM) came below expectations at -0.6% vs. 0.1% forecast.

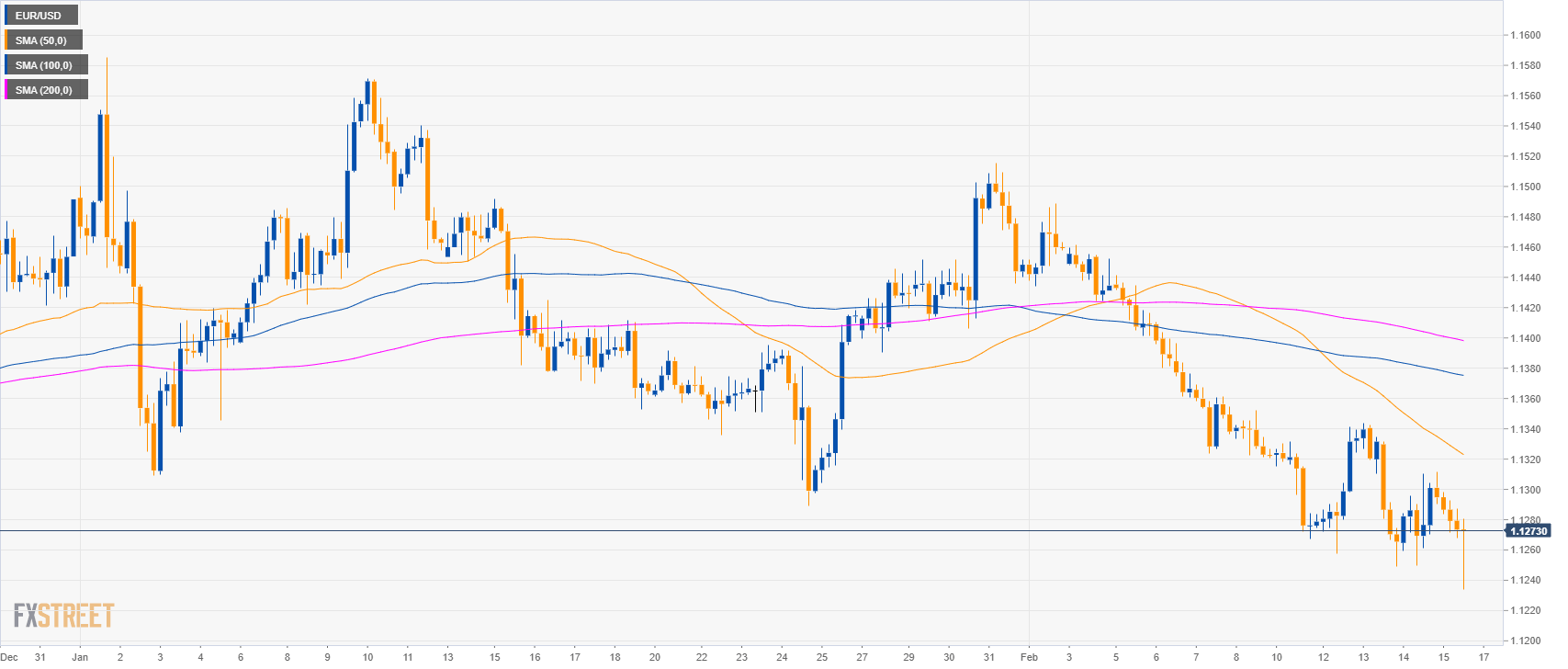

EUR/USD 4-hour chart

- EUR/USD is trading below its main SMAs suggesting bearish momentum in the medium-term.

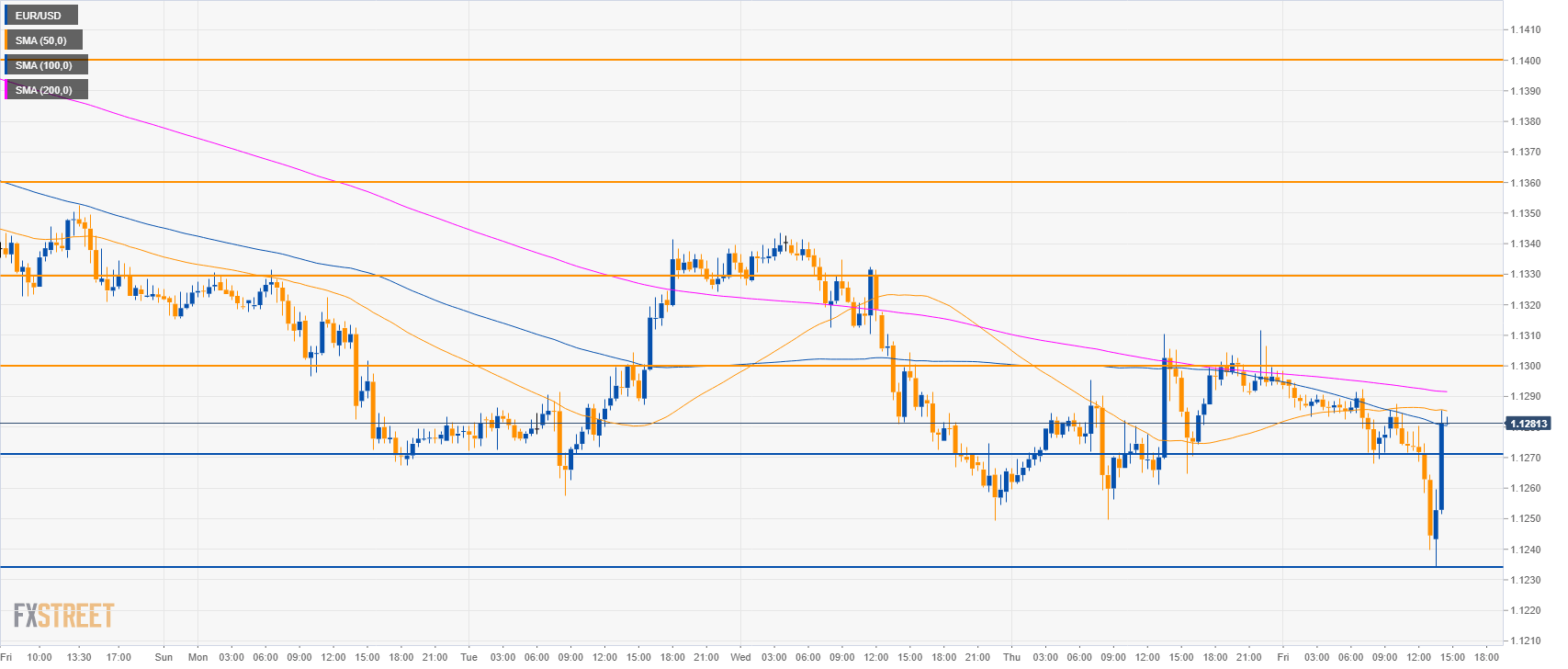

EUR/USD 30-minute chart

- EUR/USD is trading below the main SMAs suggesting bearish momentum in the short-term.

- Support is seen at 1.1230 level.

- To the upside, bulls will most likely try to recapture 1.1300, 1.1330 and 1.1400 figure.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1263

Today Daily change: -31 pips

Today Daily change %: -0.27%

Today Daily Open: 1.1294

Trends:

Daily SMA20: 1.1374

Daily SMA50: 1.1395

Daily SMA100: 1.1408

Daily SMA200: 1.1532

Levels:

Previous Daily High: 1.1311

Previous Daily Low: 1.1249

Previous Weekly High: 1.1462

Previous Weekly Low: 1.132

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1287

Daily Fibonacci 61.8%: 1.1273

Daily Pivot Point S1: 1.1258

Daily Pivot Point S2: 1.1223

Daily Pivot Point S3: 1.1197

Daily Pivot Point R1: 1.132

Daily Pivot Point R2: 1.1346

Daily Pivot Point R3: 1.1381