GBP/USD Technical Analysis: Slow lift from 1.2500 sees bears positioned for further downside

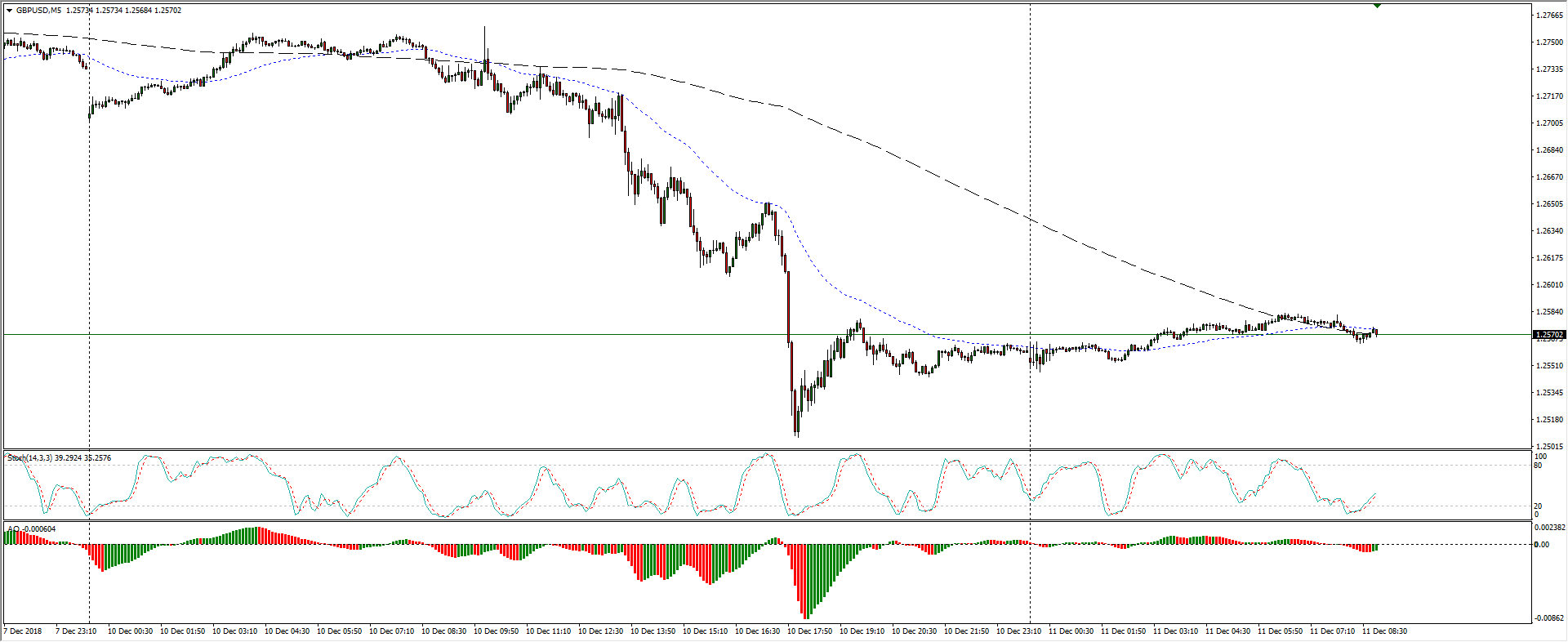

- GBP/USD remains trapped just above 1.2570, and a cautious recovery from Monday's bottom at the 1.2500 handle sees the Cable mixing with the 200-period moving average, implying the pair has lost momentum for the time being.

GBP/USD, 5-Minute

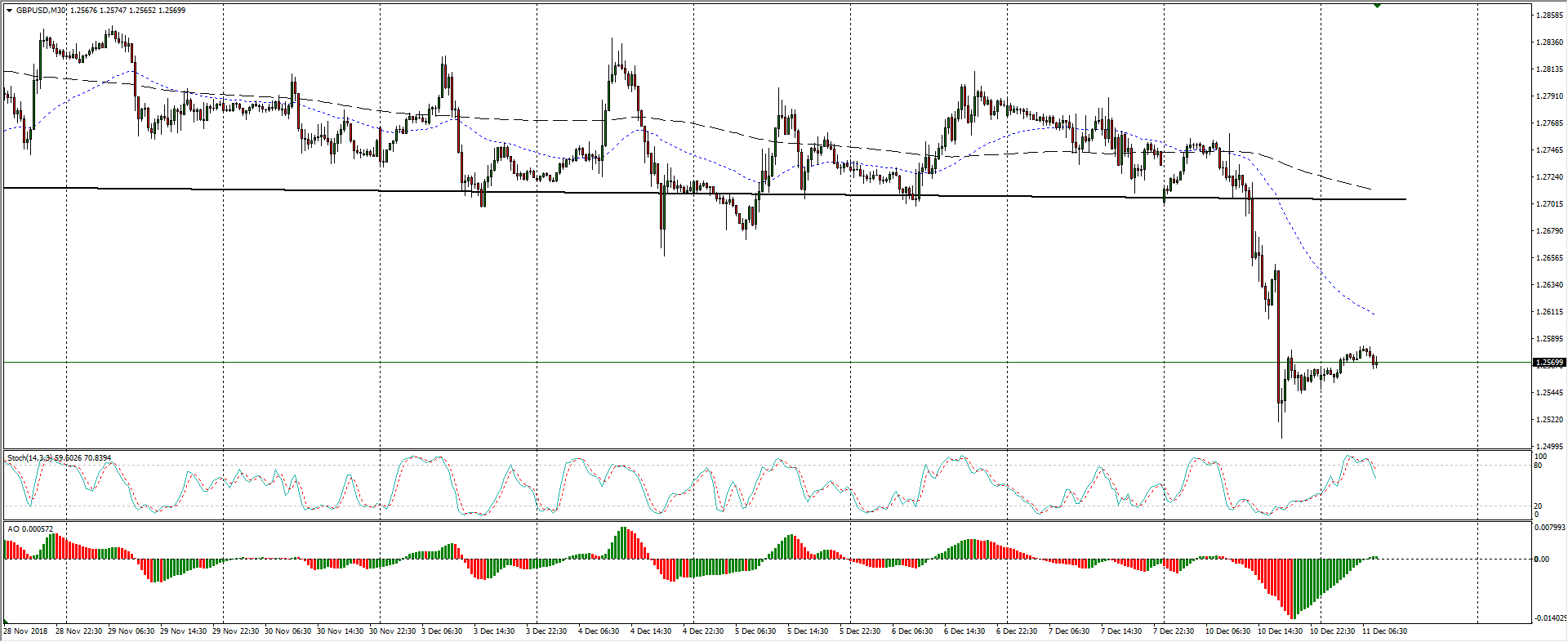

- This week's decline sees the Cable knocking down into a new support/resistance zone, and the 1.2700 key barrier that provided support in the near-term will now be a ceiling for any bullish pushes.

GBP/USD, 30-Minute

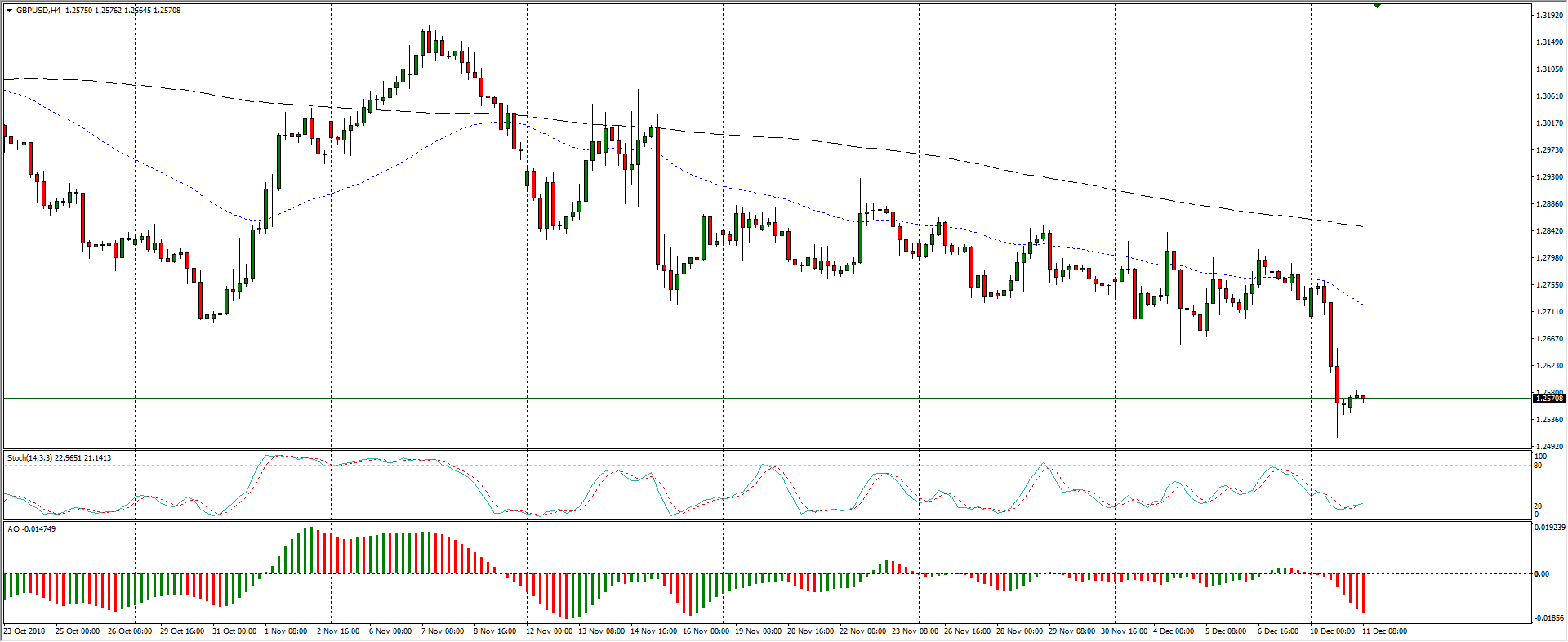

- The Cable has accelerated losses that were clearly telegraphed on the 4-hour candlesticks, and now the concern will be a bullish correction caused by profit-taking that could set up a re-test of key resistance at 1.2700 for a reload on short positions.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.257

Today Daily change: 11 pips

Today Daily change %: 0.0876%

Today Daily Open: 1.2559

Trends:

Previous Daily SMA20: 1.2792

Previous Daily SMA50: 1.2922

Previous Daily SMA100: 1.2953

Previous Daily SMA200: 1.3281

Levels:

Previous Daily High: 1.276

Previous Daily Low: 1.2507

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2604

Previous Daily Fibonacci 61.8%: 1.2663

Previous Daily Pivot Point S1: 1.2457

Previous Daily Pivot Point S2: 1.2355

Previous Daily Pivot Point S3: 1.2204

Previous Daily Pivot Point R1: 1.2711

Previous Daily Pivot Point R2: 1.2862

Previous Daily Pivot Point R3: 1.2964