EUR/USD Technical Analysis: Near-term support from 1.1330 holding for now

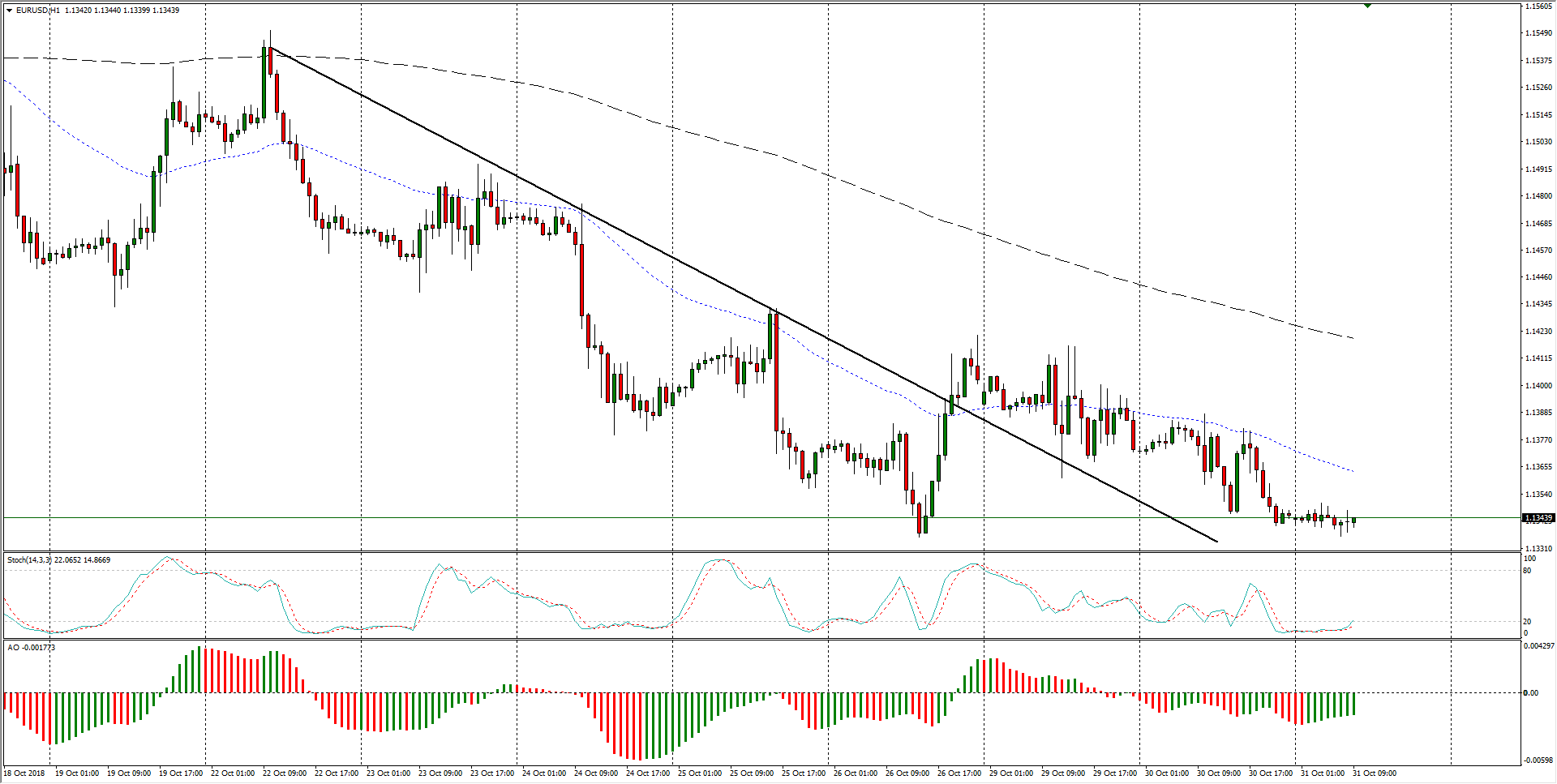

- The near-term EUR/USD chart is seeing stiff support from the 1.1335 region, where the pair bounced late last week, but the upside continues to remain limited as selling pressure keeps the Euro firmly pinned to key levels aimed towards the downside.

- EUR/USD Forecast: Deja-vu dead cat bounce with Italy's stagnation exacerbates the situation

- EUR/USD faces a hard-cap at 1.1390 on any recovery attempt – Confluence Detector

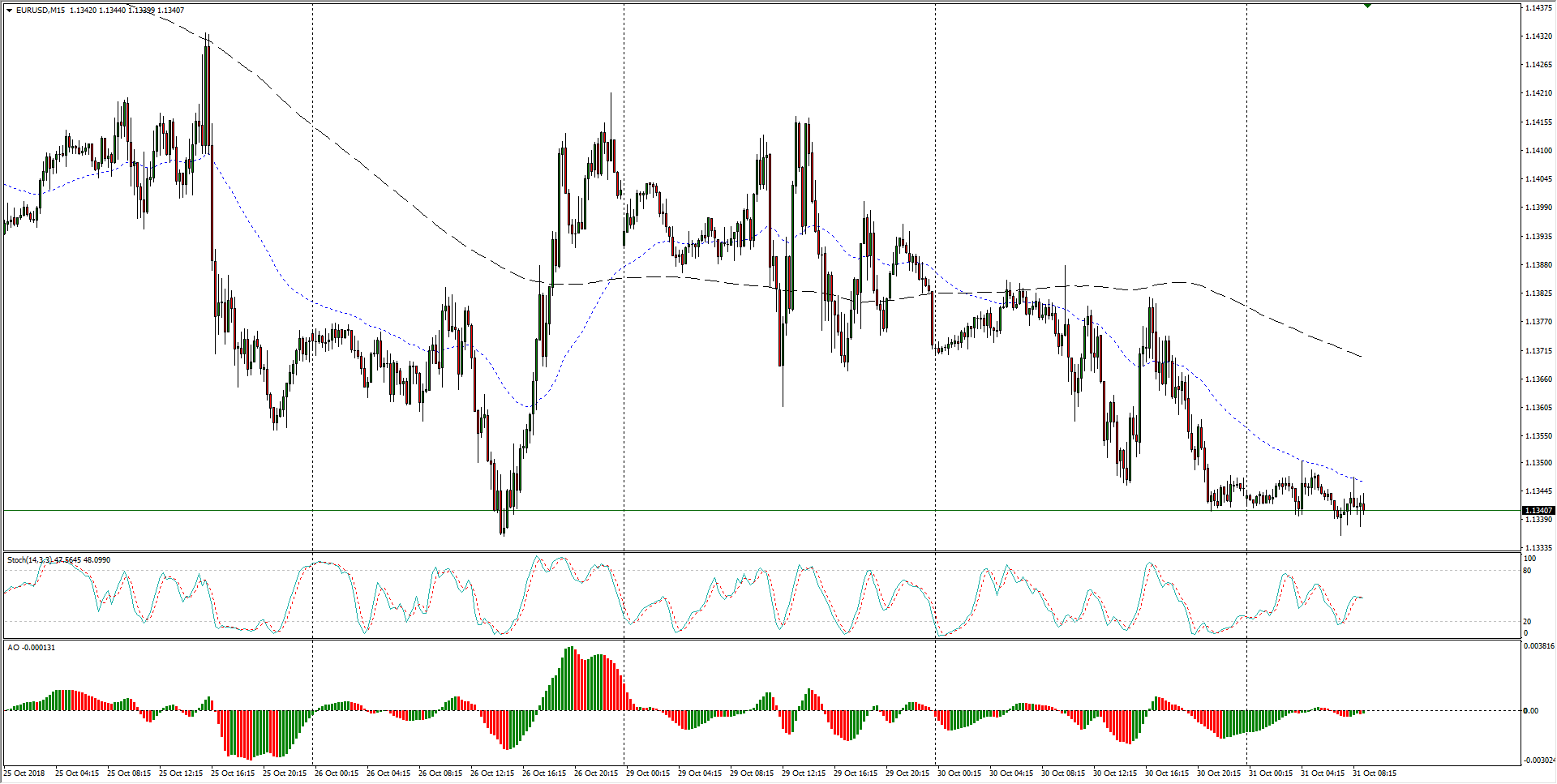

EUR/USD, M15

- Moving further up the timeframes, the Fiber has seen a notable slowdown in downward momentum, rupturing a descending near-term trendline, but a lack of broad-market risk appetite is spoiling any attempts at a bullish recovery.

EUR/USD, H1

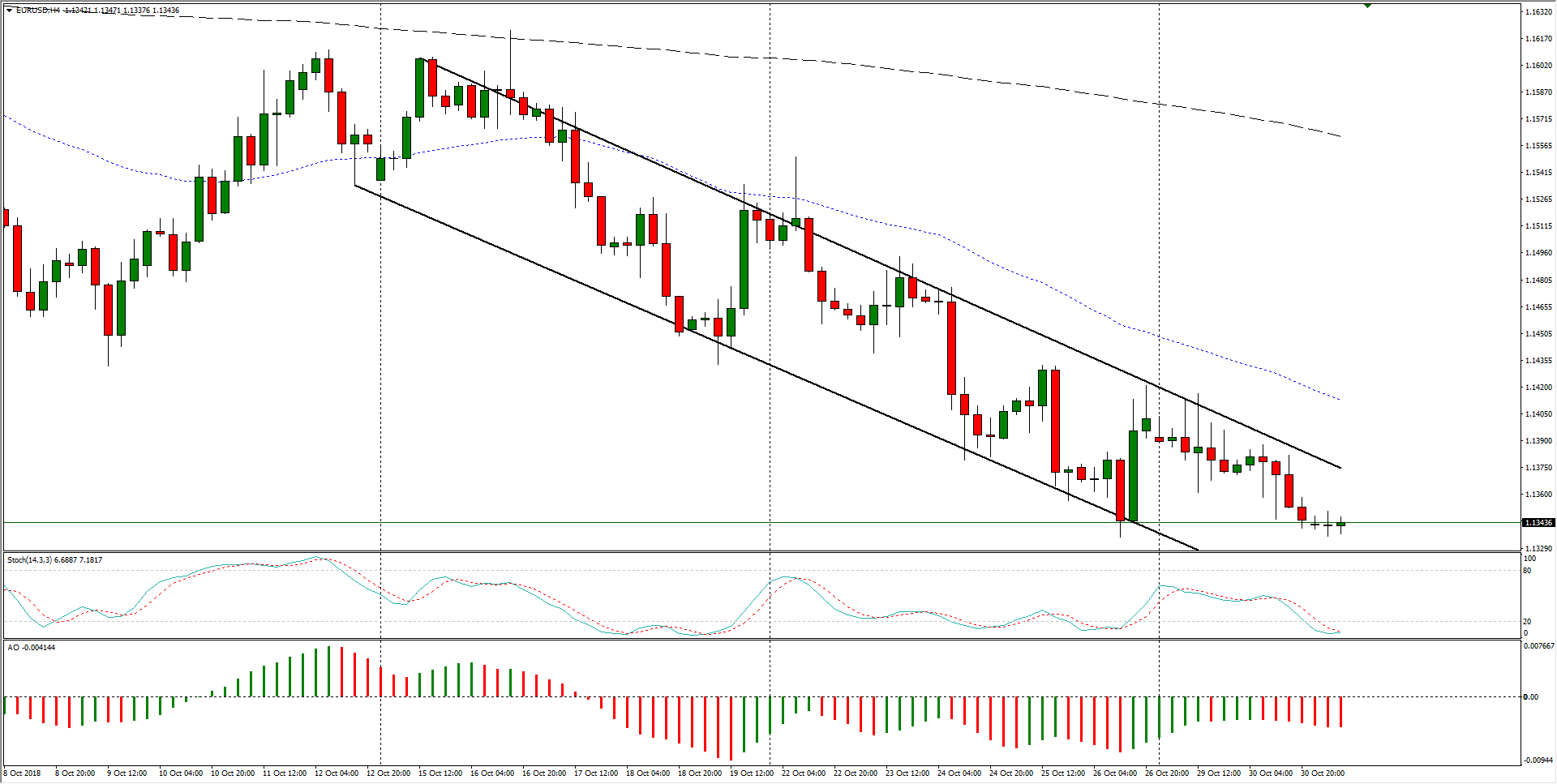

- Looking to the H4 candles, the EUR/USD continues to see play in a descending channel, and while the last swing low is currently marking out a support zone, long-term short action sees the Euro setting up for another leg lower as the Greenback remains well-bid in the fx space.

EUR/USD, H4

Don't forget to check out FXStreet's live chart for instant updates on what's happening with the EUR/USD!

EUR/USD

Overview:

Last Price: 1.1342

Daily change: -2.0 pips

Daily change: -0.0176%

Daily Open: 1.1344

Trends:

Daily SMA20: 1.1481

Daily SMA50: 1.1581

Daily SMA100: 1.1598

Daily SMA200: 1.1881

Levels:

Daily High: 1.1388

Daily Low: 1.1338

Weekly High: 1.1551

Weekly Low: 1.1336

Monthly High: 1.1816

Monthly Low: 1.1526

Daily Fibonacci 38.2%: 1.1358

Daily Fibonacci 61.8%: 1.1369

Daily Pivot Point S1: 1.1326

Daily Pivot Point S2: 1.1307

Daily Pivot Point S3: 1.1276

Daily Pivot Point R1: 1.1376

Daily Pivot Point R2: 1.1407

Daily Pivot Point R3: 1.1426