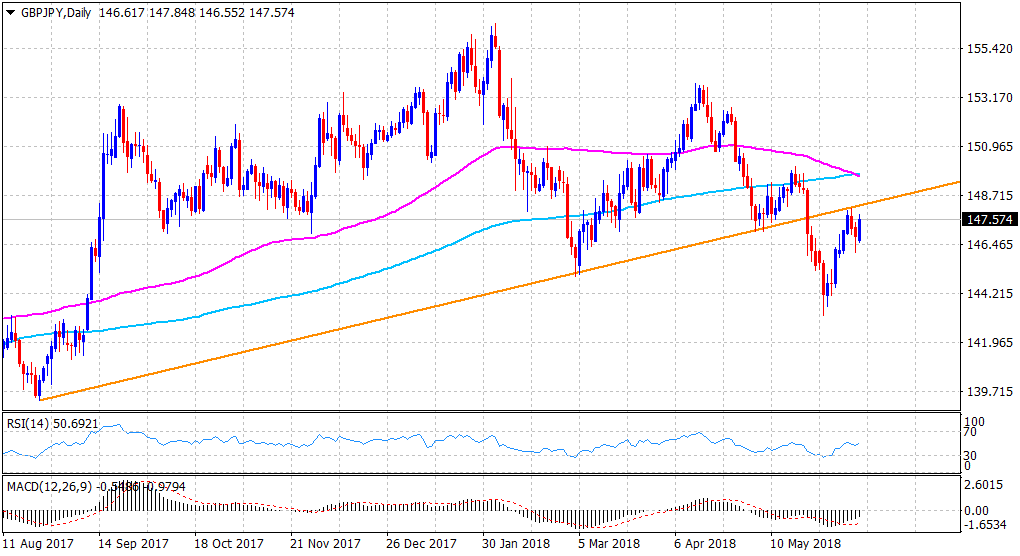

GBP/JPY Technical Analysis: jumps back closer to an important support turned resistance

• Building on Friday's goodish rebound from the 146.00 handle and the momentum is supported by risk-on mood, which was seen weighing on the JPY's safe-haven demand.

• The up-move might continue to struggle near a precious strong support now turned resistance marked by an upward sloping trend-line, extending from lows touched in August 2017 through March/May 2018 lows.

• A convincing move needed to extend the rally towards an important moving averages confluence (100 & 200-day SMAs), currently near the 149.60-70 region.

GBP/JPY daily chart

Spot Rate: 147.57

Daily Low: 146.55

Trend: Overall trend remains bearish

Resistance

R1: 148.22 (trend-line support turned resistance)

R2: 148.83 (R3 daily pivot-point)

R3: 149.11 (50-day SMA)

Support

S1: 147.00 (round figure mark)

S2: 146.79 (daily pivot-point)

S3: 146.25 (200-period SMA H1)