NZD/JPY looking for a foothold after rolling downhill into 77.50

- The Kiwi heads into a new week after getting pummeled by the Yen.

- A lack of impactful data for the early week leaves the pair exposed to market sentiment.

The NZD/JPY pair is trading back into 77.60, and the Kiwi is continuing to expose its weak side.

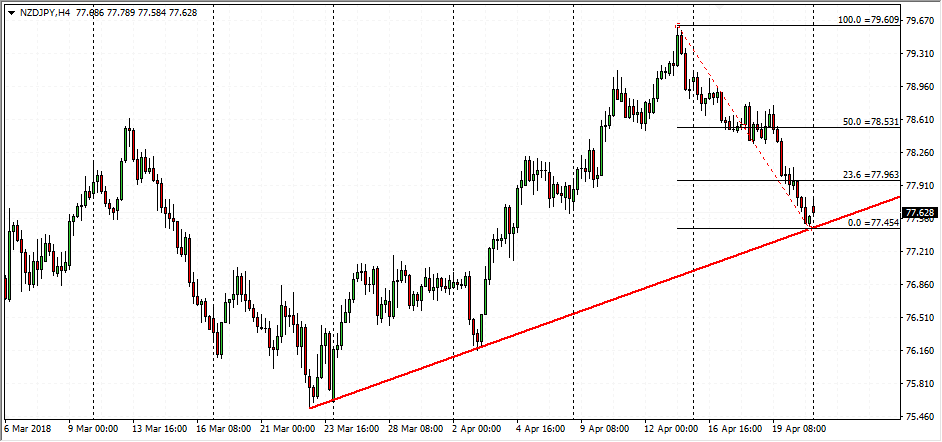

The Kiwi fell steadily against the Yen last week, dropping from a high of 79.10 into 77.45 in one-sided action, and the Kiwi is struggling to capitalize on a small bump to kick off the new week, continuing to show weakness after kicking upwards towards 77.80 to kick off the new week.

Monday is a quiet showing for the Kiwi on the economic calendar, with low-tier Credit Card Spending for March at 03:00 GMT, and the year-on-year figure last printed a 7 percent reading, while late Monday (22:45 GMT) will bring March's year-on-year figures for Visitor Arrivals. The indicator last showed an 11.4 percent upswing in tourism arrivals to New Zealand; tourism is a major part of the NZ GDP, and a healthy showing in arrivals could find the Kiwi some much-needed support.

NZD/JPY Levels to watch

Last week's tumble into 77.45 saw the pair touch into the rising trendline from March's low at 75.50, and a bullish rejection of the rising trendline will see action testing into the 50.0 Fibo level near the 78.50 handle, while a failure by bulls to regain control will see the pair falling back into support from late March's congestion zone from the 77.00 to 76.00 psychological levels.