USD/JPY finds support at 106 amid new BoJ’s Deputy Governors

-

Bank of Japan appoints new Deputy Governor Amamiya and Wakatabe.

-

The USD/JPY likely to breakout soon as the range keeps tightening.

The USD/JPY is trading at around 106.38 up 0.28% on the day so far as the parliament approved last week two new Bank of Japan’s Deputy Governors. During their introductory press conference, both Wakatabe and Amamiya made several dovish comments. A surprising remark, though, was Amamiya saying that the BoJ could raise rates before reaching the 2% target on CPI inflation. However, Amamiya said that even if the Japanese economy is not deflationary, the economy still has not met its 2% inflation target. Wakatabe insisted that the Bank must avoid premature change in monetary policy while he will not hesitate to ease policy further if necessary. The BoJ tone remains dovish as it is ready to add monetary stimulus to reach the 2% inflation target.

No market-moving event is scheduled from Japan nor the US prior to the FOMC meeting.

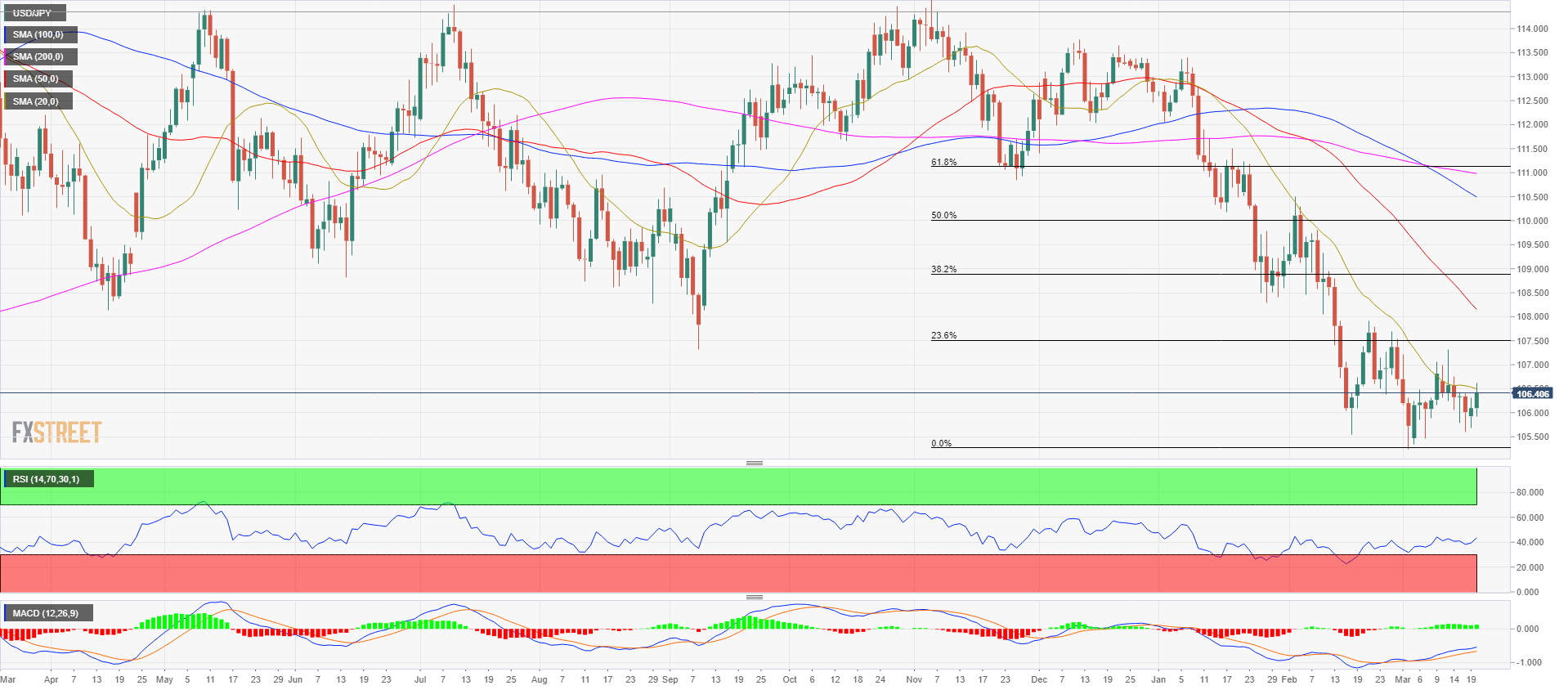

USD/JPY daily chart

On Tuesday the USD/JPY’s bulls tested the 20-period simple moving average at 106.50. As discussed yesterday the pair is balanced and neither bulls nor bears are taking major risks, especially ahead of the FOMC meeting on Wednesday. The USD/JPY is trapped in a range between 105.00 and 108.00, however, for bulls, a clear breakout above the 107.00 level might signify a trend reversal up while for bears, a clear break below the 105.00 level would confirm the bear trend continuation.