US Dollar firm above 90.00 ahead of G-20, FOMC

- The greenback is prolonging the upside above the 90.00 milestone.

- US 2-year yields clinched fresh decade-high tops above 2.30%.

- FOMC meeting, G-20 gathering in centre stage later in the week.

The greenback, tracked by the US Dollar Index (DXY), is extending its march north on Monday and is looking to consolidate the recent breakout of the 90.00 handle.

US Dollar looks to Fed, tariffs

The index is advancing for the fourth session in a row so far today, prolonging the bounce off last week’s support in the mid-89.00s.

Broad risk appetite trends continue to be the almost exclusive catalyst behind the buck’s price action, although trade issues and a pick up in geopolitical concerns following the UK-Russia poison scandal are also collaborating with the sentiment.

Ahead in the week, the Federal Reserve is widely expected to hike rates although the focus of attention will be on the tone of the first meeting lead by Chief Powell and the fresh projections from the FOMC.

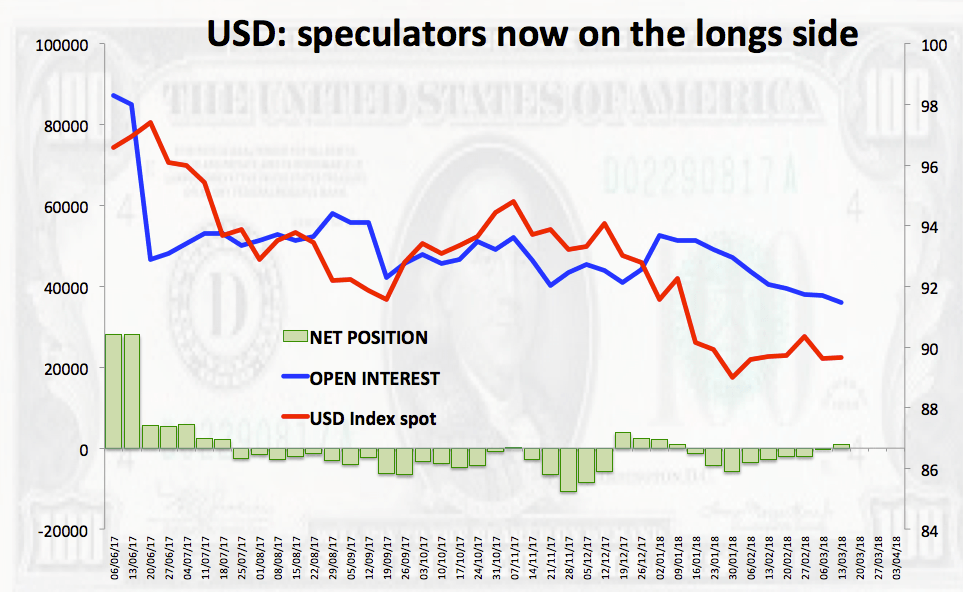

Further news around USD noted speculators are now holding net longs positions for the first time since January 9, as per the latest CFTC report for the week ended on March 13.

US Dollar relevant levels

As of writing the index is gaining 0.08% at 90.26 facing the next up barrier at 90.57 (high Feb.8) seconded by 90.93 (high Mar.1) and finally 91.00 (high Jan.18). On the flip side, a breakdown of 89.88 (23.6% Fibo of 95.15-88.25) would open the door to 89.56 (low Mar.14) and then 89.41 (low Mar.7).