EUR/USD faded the bull run to 1.2300

- Gains in spot appear capped near 1.2300.

- Sentiment around USD remains offered.

- US key data next on tap (Wednesday).

The European currency sticks to the positive territory so far on Monday, although rallies in EUR/USD appear so far capped around the 1.2300 handle.

EUR/USD supported near 1.2200

After briefly testing fresh multi-week lows in the boundaries of the 1.2200 handle during last week, the pair managed to grab some buying interest and is now meandering the upper end of the recent range in the 1.2270/80 band, all amidst an offered tone around the buck.

Empty dockets in both Euroland and the US economy should leave the bulk of the attention to the broader risk appetite trends while markets shift their focus to the upcoming US inflation figures tracked by the CPI and retail sales, both due on Wednesday.

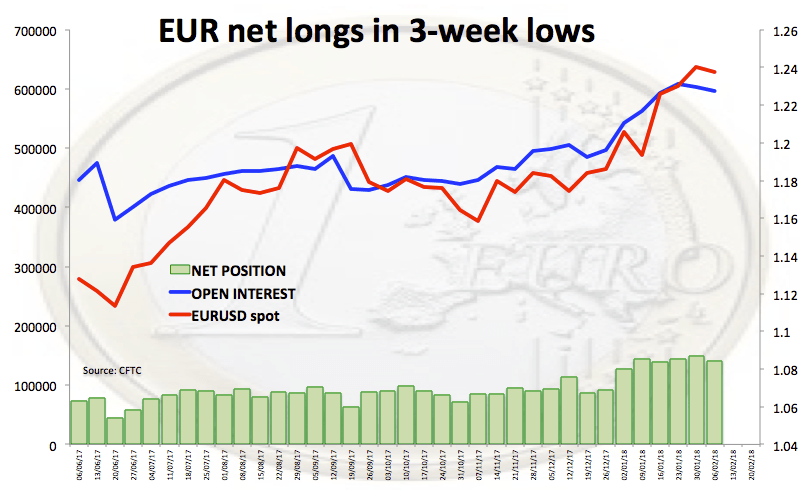

News from the latest CFTC report showed EUR net longs retreated to fresh 3-week lows in the week to February 6.

EUR/USD levels to watch

At the moment, the pair is up 0.15% at 1.2268 and a breakout of 1.2329 (21-day sma) would target 1.2356 (10-day sma) en route to 1.2524 (high Feb.1). On the flip side, the immediate support emerges at 1.2206 (low Feb.9) seconded by 1.2167 (50% Fibo of the 2014-2017 drop) and finally 1.2165 (low Jan.18).