WTI keeps gains post-EIA, around $48.80

A higher than expected build in US crude oil supplies is not denting the upside of WTI prices, which remain in the upper end of the daily range near $48.80.

WTI bid on large gasoline draw

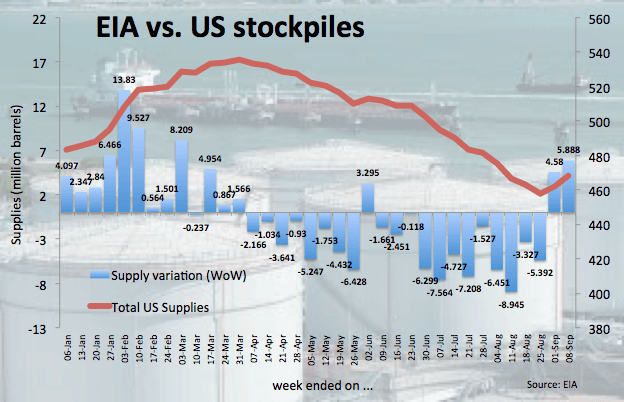

Prices of the barrel of West Texas Intermediate keep the positive note on Wednesday despite the EIA reported an unexpected build of 5.888 million barrels during the week ended on September 8, recording at the same time the second consecutive increase in supplies.

In addition, gasoline inventories dropped by 8.428 million barrels and weekly distillate stocks also decreased more than expected by 3.215 million barrels. Further data saw supplies at Cushing going up by 1.023 million barrels.

Ahead in the week, key US inflation figures (Thursday) and retail sales (Friday) should keep the focus on the buck, while driller Baker Hughes will release its weekly oil rig count also on Friday.

WTI significant levels

At the moment the barrel of WTI is gaining 0.66% at $48.55 facing the immediate hurdle at $49.42 (high Sep.6) followed by $49.59 (200-day sma) and finally $50.22 (high Aug.10). On the other hand, a breach of $48.58 (61.8% Fibo of the August drop) would aim for $48.14 (10-day sma) and then $47.69 (21-day sma).