EUR/USD clocks fresh 2-year high, all eyes on German & EZ PMIs

The EUR/USD rose to a fresh two-year high of 1.1284 in Asia as the political uncertainty in the US continued to weigh over the greenback.

Tests 23.6% Fib R of the sell-off from 2008 high

The 23.6% Fibonacci retracement level of the sell-off from 1.6038 (2008 high) to 1.0341 (Jan 2017 low) stands at 1.1285. The currency pair almost tested the key level in Asia and may convincingly break the same in favor of 1.1713 (Aug 2015 high) if the preliminary German and Eurozone manufacturing PMI beats estimates.

It’s all about PMI

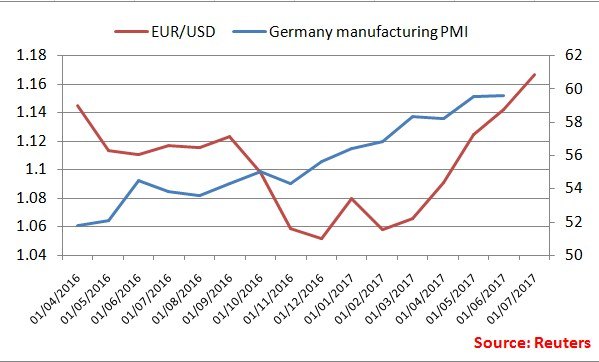

The above chart clearly shows - the spike in the German manufacturing PMI and EZ PMIs in general in late 2016 boosted the appeal of the EUR as a growth currency, resulting in a five-month rally in the EUR.

The 14-day RSI is most overbought since August 2015. The weekly RSI is overbought as well. Hence, the continuation of the rally would require a better-than-expected German and EZ PMI numbers.

The preliminary German PMI, due at 7:30 GMT, is expected to show a slight slowdown in the pace of expansion of the manufacturing activity in July (expected 59.2, previous 59.6). Later in the day, the broader market sentiment and the US political situation would once again come into play.

EUR/USD Technical Levels

A break above 1.1685 (23.6% Fib R of 2008 high - 2017 low) would open doors for 1.1713 (Aug 2015 high). Two consecutive daily close above the same could yield 1.1890 (monthly 50-MA) levels. On the downside, breach of support at 1.1660 (session low) would open up downside towards 1.1607 (5-DMA) and 1.1576 (1-hour 100-MA).