USD/JPY plummets to lows near 112.30, US data eyed

The greenback continues to grind lower vs. its Japanese counterpart at the end of the week, with USD/JPY probing lows in the 112.30 region.

USD/JPY weaker, US yields tumbles

Spot is rapidly losing momentum today, coming down to test fresh 2-week lows in the 112.30 area and posting losses for the third session in a row so far.

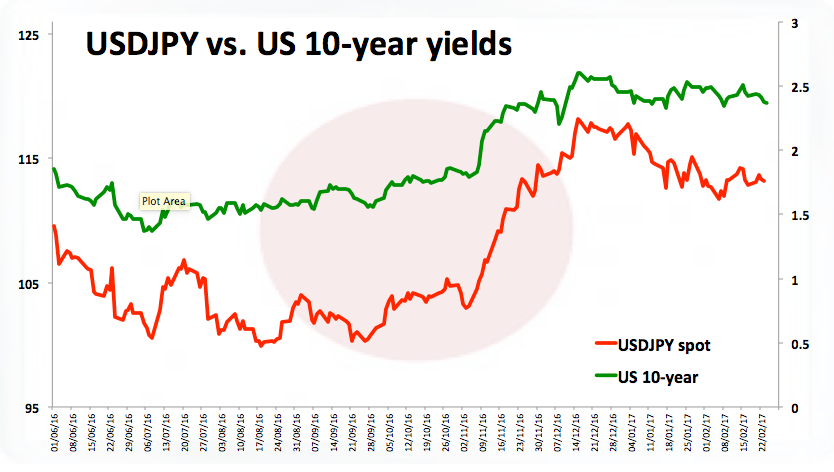

The pair is echoing the poor performance from yields in the US money markets, where the 10-year reference is so far flirting with multi-day lows around 2.36% amidst a generalized downside sentiment.

In addition, the US Dollar Index is extending its leg lower today in response to yesterday’s comments by US Treasury Secretary S.Mnuchin, falling to weekly lows in the 100.70 area.

In the data space, US New Home Sales and the Reuters/Michigan index are due later.

USD/JPY levels to consider

As of writing the pair is retreating 0.30% at 112.27 facing the initial support at 112.03 (low Feb.2) followed by 111.98 (38.2% Fibo of the November-December up move) and then 111.73 (100-day sma). On the upside, a break above 113.05 (20-day sma) would open the door to 113.78 (high Feb.21) and then 114.36 (high Feb.16).