Back

23 Oct 2023

Crude Oil Futures: Extra losses not ruled out

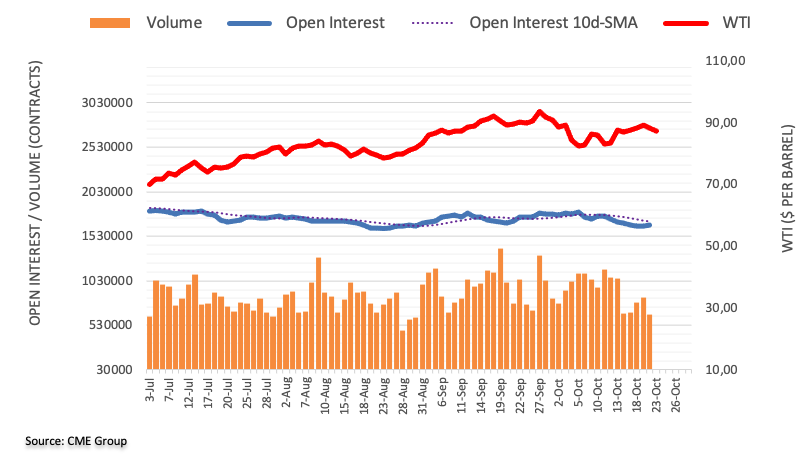

CME Group’s flash data for crude oil futures markets noted traders added around 4.3K contracts to their open interest positions at the end of last week, reversing a multi-day negative trend. Volume, instead, left behind three consecutive daily retracements and went up by around 182.3K contracts.

WTI: Next on the downside comes $81.50

WTI prices retreated from the area of weekly peaks on Friday, closing the session with humble losses. The downtick was on the back of increasing open interest, which hints at the potential continuation of the decline in the very near term. That said, further selling pressure should meet the next support around the monthly lows near $81.50 (October 6).